Cryptocurrencies have come a long way since the inception of Bitcoin. Ethereum and Cardano have emerged as frontrunners in the realm of smart contracts, enabling the creation of decentralized applications and executing self-executing agreements without intermediaries. This article aims to dissect the strengths, weaknesses, and unique features of both platforms.

Understanding Smart Contracts

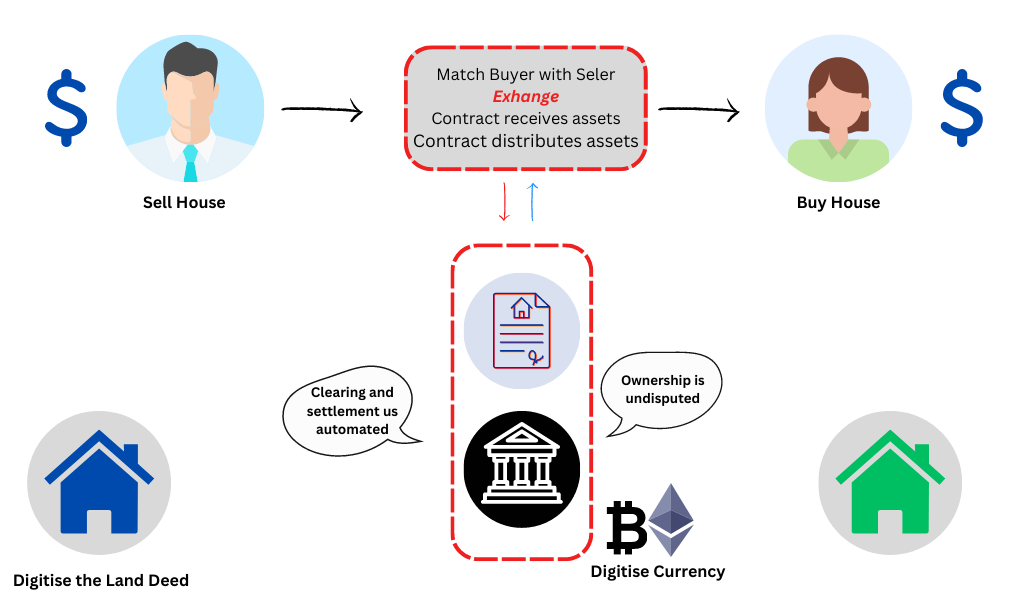

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute when specific conditions are met, eliminating the need for intermediaries and enhancing transparency and efficiency.

Ethereum’s Smart Contract Dominance

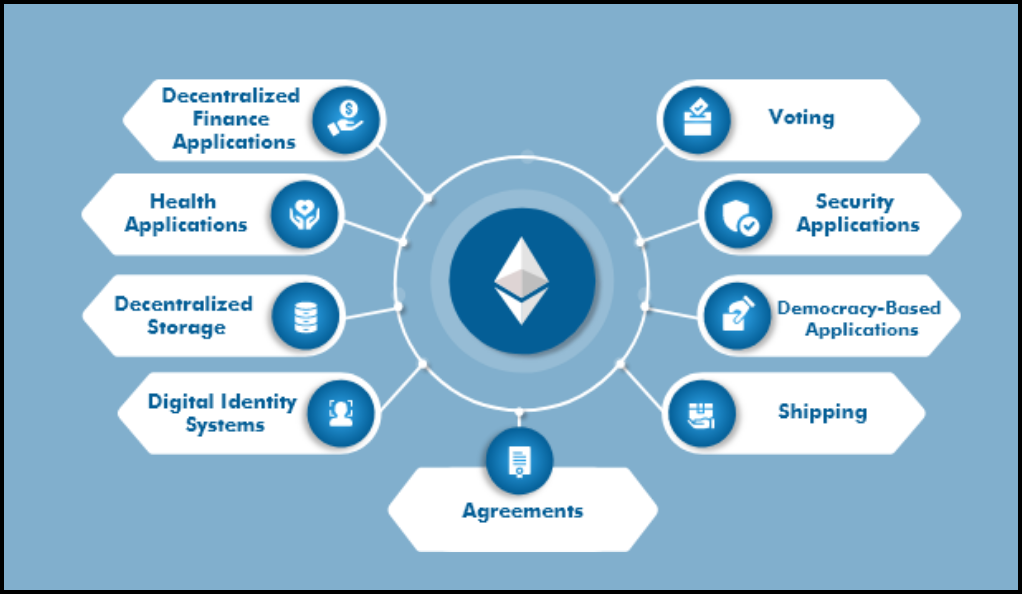

Ethereum, often referred to as the pioneer of smart contracts, revolutionized the blockchain landscape by introducing a decentralized platform for building applications. Its Turing-complete programming language, Solidity, paved the way for a wide range of applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs).

The Rise of Cardano

Cardano, on the other hand, emerged with a focus on research-driven development, aiming to address the limitations of existing blockchain platforms. Its approach, grounded in peer-reviewed academic research, aims to achieve scalability, sustainability, and interoperability while ensuring security.

Comparing Features and Capabilities

Scalability

Ethereum has faced scalability challenges due to its proof-of-work consensus mechanism. However, Ethereum 2.0’s transition to proof-of-stake aims to mitigate these issues. Cardano, on the other hand, employs a layered architecture that separates transactions from smart contracts, enhancing scalability.

Security

Ethereum’s security relies on the correct implementation of smart contracts, occasionally leading to vulnerabilities. Cardano’s approach involves thorough research and formal verification methods to minimize the risk of bugs and vulnerabilities.

Interoperability

Cardano’s emphasis on interoperability allows different blockchains to communicate seamlessly. Ethereum, while not inherently interoperable, has seen the development of solutions like the Polygon network to address this concern.

Utilities and Use Cases

Ethereum’s Applications

Ethereum’s extensive ecosystem hosts a plethora of applications, including decentralized exchanges, lending platforms, and NFT marketplaces. Its first-mover advantage has attracted a wide array of developers and users.

Cardano’s Potential

Cardano aims to provide a platform for governments, enterprises, and individuals in developing countries to access financial services. Its focus on regulatory compliance and sustainability opens doors for various real-world applications.

Market Potential and Investment Considerations

Ethereum’s Market Presence

Ethereum boasts a significant market capitalization and adoption rate. However, the transition to Ethereum 2.0 is pivotal for its continued growth, addressing scalability and energy consumption concerns.

Cardano’s Growing Popularity

Cardano’s unique features and academic approach have garnered attention from both investors and institutions. Its growth potential lies in its ability to deliver on its promises and differentiate itself from competitors.

The Community Factor

Both Ethereum and Cardano have passionate and engaged communities. Ethereum’s established community has contributed to its growth, while Cardano’s community embraces its scientific approach and long-term vision.

Future Developments and Upgrades

Ethereum’s transition to Ethereum 2.0 is a highly anticipated upgrade that aims to enhance scalability and energy efficiency. Cardano’s rollout of various phases, including smart contract capabilities, showcases its commitment to continuous improvement.

Challenges and Concerns

Ethereum’s scalability challenges and energy consumption issues need to be addressed for its sustained success. Cardano faces the task of delivering on its research-driven promises while staying competitive in a rapidly evolving industry.

Conclusion

In the dynamic landscape of cryptocurrencies, Ethereum and Cardano emerge as formidable contenders in the smart contract arena. Ethereum’s established ecosystem and Cardano’s research-driven approach both bring unique strengths to the table. The choice between these titans ultimately depends on one’s priorities – whether it’s immediate utility or long-term potential.

FAQs

Ethereum is known for its first-mover advantage and extensive application ecosystem, while Cardano focuses on research-driven development and regulatory compliance.

Cardano’s layered architecture gives it an edge in scalability, but Ethereum is undergoing upgrades to enhance its scalability through Ethereum 2.0.

Ethereum’s smart contracts power decentralized finance (DeFi) platforms, non-fungible token (NFT) marketplaces, and more.

Yes, Cardano’s emphasis on regulatory compliance and sustainability makes it an attractive option for institutions.

Ethereum 2.0 aims to improve scalability and energy efficiency, offering users a more sustainable and efficient platform for their applications.

Bitcoinnewsmagazine is committed to providing impartial and reliable insights into cryptocurrency, finance, trading, and stocks. It's important to note that we do not provide financial advice, and we strongly encourage users to conduct their own research and due diligence.

Read More