In the digital age, as we exchange information at lightning speed and demand more secure, transparent transactions, blockchain technology stands out as a game-changer. So, what is blockchain, and why do many consider it the next big thing in finance and beyond?

What is Blockchain?

At its core, blockchain is a distributed ledger technology. Imagine a book, where each page of the book represents a block, and every time you turn a page, you can see a summary of the previous page, ensuring continuity and integrity of the content. In the digital realm, this “book” is a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block typically contains a cryptographic hash of the previous block, a timestamp, and transaction data.

| Component | Description |

|---|---|

| Block | A container data structure that aggregates transactions for inclusion in the public ledger, the blockchain. |

| Cryptographic Hash | A function that converts an input into a fixed-size string of bytes, which typically appears random. It ensures data integrity. |

| Timestamp | A sequence of characters that identifies when a certain event occurred, giving a chronological order to the blocks. |

| Transaction Data | Information related to the transaction, such as sender, receiver, amount, etc. |

Why is it Revolutionary?

Blockchain’s design actively defends against data modification. Once a block records data, you can’t change it retroactively without also changing all the following blocks. This defense ensures top-notch data integrity and security. Additionally, its decentralized structure ensures that no single entity controls the entire blockchain, and the ledger transparently records all transactions for anyone to access. This structure removes the need for middlemen, speeding up transactions, enhancing transparency, and reducing fraud risks.

In financial terms, envision blockchain as a clear, unalterable ledger that displays, verifies, and logs every financial transaction. This means no more hidden fees, no long waits for transaction processing, and a drastic cut in potential fraud.

Historical Evolution of Blockchain

The roots of blockchain technology can be traced back further than one might initially believe. While the term “blockchain” has become synonymous with the rise of cryptocurrencies in the 21st century, its foundational concepts have been around for decades.

The Precursors to Modern Blockchain

In the early 1980s, cryptographer David Chaum introduced the idea of cryptographic electronic money called “ecash.” This concept laid the groundwork for the development of digital signatures, a crucial component in the verification process of modern blockchain transactions.

Fast forward to 1991, Stuart Haber and W. Scott Stornetta proposed a cryptographically secure chain of blocks wherein no document’s timestamp could be tampered with. This was the first mention of a chain of blocks, bearing a striking resemblance to today’s blockchain.

Key Milestones in Blockchain Evolution

- 1982: David Chaum’s eCash

- Introduction of cryptographic electronic money.

- 1991: Haber and Stornetta’s Proposal

- First concept of a secure chain of blocks.

- 2008: Satoshi Nakamoto’s Whitepaper

- Introduction of the concept of a decentralized cryptocurrency, Bitcoin, and its underlying blockchain technology.

- 2016: Rise of Ethereum

- Introduction of smart contracts and a platform for building decentralized applications.

The Birth of Bitcoin and Beyond

The term “blockchain” became widely recognized in 2008 when an individual (or group) under the pseudonym Satoshi Nakamoto released a whitepaper detailing a decentralized digital currency named Bitcoin. Nakamoto’s Bitcoin solved the double-spending problem, a significant hurdle in digital currency, by ensuring that each unit of digital value was spent only once. This was achieved without the need for a central authority or intermediary, a revolutionary concept that challenged the traditional financial system.

Bitcoin’s underlying technology, the blockchain, was the real marvel. It offered a transparent, immutable, and decentralized ledger of all transactions. The success of Bitcoin spurred the development of numerous other cryptocurrencies and opened the door for blockchain’s potential beyond just currency transactions.

In 2016, another significant development occurred with the introduction of Ethereum by Vitalik Buterin. Ethereum expanded on Bitcoin’s foundational blockchain principles by introducing “smart contracts” – self-executing contracts with the terms of the agreement directly written into code. This allowed for the creation of decentralized applications, broadening the scope and potential applications of blockchain technology.

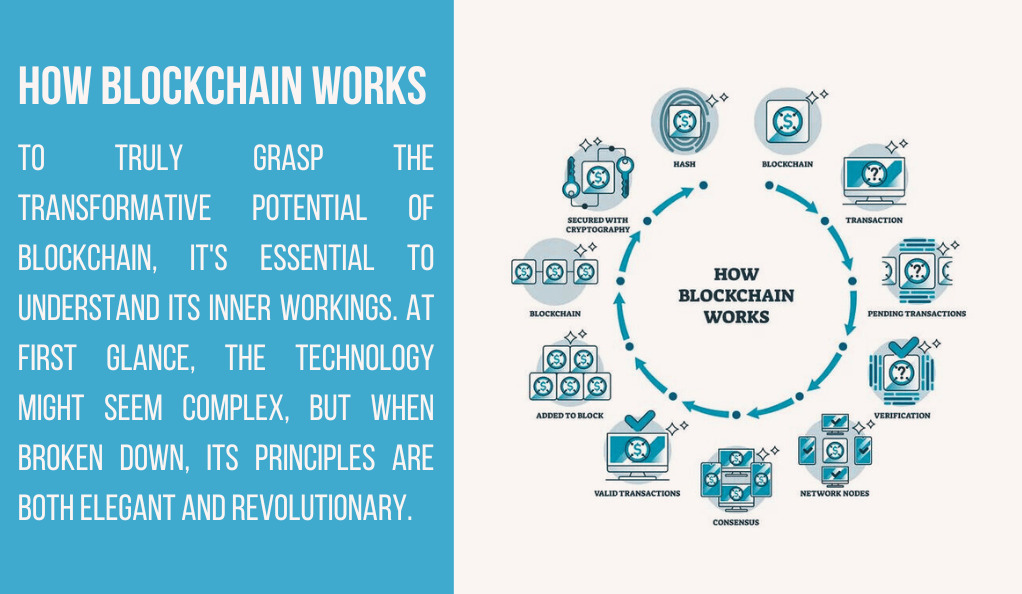

How Blockchain Works

To truly grasp the transformative potential of blockchain, it’s essential to understand its inner workings. At first glance, the technology might seem complex, but when broken down, its principles are both elegant and revolutionary.

The Anatomy of a Block

Every blockchain starts with a genesis block, the first block in the chain. Subsequent blocks are added as more transactions occur. Each block contains:

- Data: This pertains to the specifics of the transactions, such as sender, receiver, amount, and other relevant details.

- Hash: A unique code generated cryptographically. Think of it as a digital fingerprint that represents the contents of the block.

- Previous Hash: The hash of the block that came before the current one, creating a link in the chain.

Decentralization and Consensus

One of the standout features of blockchain is its decentralized nature. Instead of a single entity or authority overseeing and validating transactions, multiple participants (nodes) hold a copy of the blockchain. When a new block is added, all nodes in the network must reach a consensus that the block is valid. This consensus mechanism ensures that only legitimate transactions are added to the blockchain.

There are various methods to achieve this consensus, with “Proof of Work” and “Proof of Stake” being the most popular. These methods require participants to solve complex mathematical problems or hold a certain amount of the cryptocurrency to validate and add new blocks.

Immutable and Transparent

Once you add a block to the blockchain, it becomes unchangeable and cannot be altered or deleted. Cryptographic hashes ensure this unchangeability. If someone attempts to modify the information in a block, the hash changes, disrupting the connection to the following block. To validate this change, they would need to modify all the following blocks, a task nearly impossible due to the consensus requirement.

Additionally, blockchain’s transparency allows anyone to see the full transaction history, promoting both accountability and trust.

Blockchain’s Role in Financial Transactions

The financial sector, with its intricate web of intermediaries, has long been ripe for disruption. Blockchain, with its promise of transparency, security, and decentralization, is poised to be that disruptive force. Let’s delve into how this technology is reshaping the financial landscape.

Solving the Double-Spending Problem

One of the biggest hurdles in digital transactions is the double-spending problem. Simply put, this problem arises when someone tries to spend a digital currency more than once. While traditional financial systems use centralized entities like banks to tackle this issue, blockchain provides a decentralized answer.

Through its consensus mechanisms, blockchain verifies a transaction and then locks it in, making it unchangeable. This process ensures that no one can spend the same digital coin or token again, cutting out the middlemen and speeding up transactions while also reducing costs.

Decentralized Finance (DeFi)

A term that has gained immense traction in recent years is “Decentralized Finance” or DeFi. It refers to the use of blockchain and cryptocurrencies to create financial systems that operate without traditional intermediaries. Examples include:

- Decentralized Exchanges (DEXs): Platforms where users can trade cryptocurrencies directly, without relying on a centralized entity.

- Lending Platforms: Users can lend or borrow funds directly, with smart contracts automating the terms and ensuring compliance.

- Stablecoins: Cryptocurrencies pegged to stable assets like gold or fiat currencies, offering price stability.

Popular DeFi Platforms and Their Functions

In the realm of Decentralized Finance (DeFi), several platforms have emerged as leaders, each offering distinct functionalities. Uniswap stands out as a prominent Decentralized Exchange (DEX), allowing users to trade cryptocurrencies directly without the need for a centralized intermediary. On the other hand, Compound has carved a niche for itself by facilitating peer-to-peer lending and borrowing, automating the process with blockchain’s inherent transparency and security. Additionally, Tether has gained traction as a stablecoin, with its value pegged to the US Dollar, providing a stable medium of exchange in the often volatile crypto market.

Cross-Border Transactions

Blockchain excels notably in handling cross-border transactions. While traditional methods use multiple intermediaries, resulting in high fees and extended processing times, blockchain facilitates direct peer-to-peer transactions. This approach slashes costs and completes transactions in mere minutes, if not seconds.

Tokenization of Assets

Blockchain has revolutionized finance with another groundbreaking application: asset tokenization. This process transforms asset rights into digital tokens on a blockchain. You can tokenize everything from real estate to artwork, which enables fractional ownership and introduces liquidity to previously illiquid markets.

Public vs. Private Blockchains

As the adoption and understanding of blockchain technology grow, it’s essential to differentiate between its various types. The two primary categories of blockchains are public and private, each with its unique features, advantages, and applications.

Public Blockchains: Open and Decentralized

Public blockchains, as the name suggests, are open to anyone. They are decentralized, meaning no single entity has control over the network. Some key characteristics include:

- Permissionless: Anyone can join the network, validate transactions, or mine new blocks.

- Transparency: All transactions are visible to anyone on the network.

- Security: Due to their decentralized nature, public blockchains are highly secure against malicious attacks.

- Examples: Bitcoin and Ethereum are the most notable public blockchains.

Private Blockchains: Restricted and Centralized

Private blockchains, on the other hand, are restricted to a specific group of participants. They are often used by businesses for internal purposes. Key features include:

- Permissioned: Only authorized participants can join the network.

- Efficiency: Transactions are faster due to fewer participants and a streamlined consensus mechanism.

- Control: A central authority often oversees the network, ensuring compliance and governance.

- Examples: Hyperledger and Corda are popular private blockchain platforms.

| Feature | Public Blockchain | Private Blockchain |

|---|---|---|

| Access | Open to anyone | Restricted |

| Control | Decentralized | Centralized |

| Speed | Slower due to more participants | Faster due to fewer participants |

| Security | Highly secure but transparent | Secure with more privacy |

| Use Cases | Cryptocurrencies, Decentralized Apps | Business processes, Supply chain |

Hybrid Blockchains: Best of Both Worlds

Recognizing the strengths and weaknesses of both public and private blockchains, some platforms opt for a hybrid approach. These blockchains combine the openness of public networks with the control of private ones, allowing businesses to operate in a semi-decentralized manner.

The Debate: Openness vs. Control

The choice between public and private blockchains often boils down to the trade-off between openness and control. While public blockchains offer unparalleled security and transparency, they might not be suitable for all applications, especially those requiring privacy and rapid transaction speeds. Private blockchains, with their controlled access, cater to such needs but at the expense of full decentralization.

Security and Trust in Blockchain

In the digital age, where cyber threats are ever-evolving, the need for secure systems is paramount. Blockchain, often touted for its security features, has become a beacon of trust in this landscape. But how does it achieve this level of security, and are there any vulnerabilities we should be aware of?

Byzantine Fault Tolerance (BFT)

One of the foundational principles ensuring the security of blockchain is the Byzantine Fault Tolerance (BFT). It’s a solution to the Byzantine Generals’ Problem, a situation where distributed systems need to agree on a single strategy to avoid failure, even when some of the systems are unreliable or malicious.

In blockchain terms, BFT ensures that the network can reach a consensus and continue to function even if some nodes (participants) act maliciously or become compromised.

Cryptography: The Shield of Blockchain

At the heart of blockchain’s security is cryptography. Each transaction is encrypted and linked to the previous one using cryptographic hashes. This ensures:

- Data Integrity: Once a block is added to the chain, altering its content would change its hash, breaking the chain’s continuity. To successfully tamper with a block, an attacker would need to alter all subsequent blocks, which is computationally infeasible.

- Authentication: Digital signatures, based on public and private key cryptography, ensure that only the rightful owner of an asset can initiate a transaction.

Decentralization: Strength in Numbers

The decentralized nature of blockchain is another layer of its security armor. With multiple copies of the ledger distributed across nodes worldwide, a potential attacker would need to compromise more than half of the network to gain control, a task that’s both costly and complex.

Potential Vulnerabilities

While blockchain boasts robust security features, it’s not entirely invulnerable:

- 51% Attack: If a single entity gains control of more than 50% of a network’s mining power, they can potentially double-spend coins and prevent other miners from completing blocks.

- Smart Contract Flaws: In platforms like Ethereum, if a smart contract is poorly coded, it can be exploited.

- Quantum Computing: Future advancements in quantum computing could pose threats to the cryptographic principles underpinning blockchain.

Building Trust in a Trustless System

The paradox of blockchain is that it builds trust in a trustless environment. Without relying on intermediaries or central authorities, it offers a transparent, immutable, and secure platform for transactions. This trust is achieved through its consensus mechanisms, cryptographic security, and decentralized architecture.

The Future of Blockchain in Finance

As we’ve journeyed through the intricacies of blockchain, its historical context, and its transformative role in the financial sector, it’s time to cast our gaze forward. What does the future hold for blockchain in finance? How will this technology further reshape the financial landscape in the coming decades?

Integration with Traditional Banking

While many view blockchain as a disruptor to traditional banking, it’s more likely that we’ll see an integration of the two. Banks are beginning to recognize the potential benefits of blockchain, from reduced transaction costs to enhanced security. We can expect more banks to adopt blockchain for various services, from cross-border payments to identity verification.

Central Bank Digital Currencies (CBDCs)

Several countries are exploring the idea of launching their digital currencies, backed and regulated by the central bank. These CBDCs would combine the benefits of cryptocurrencies, like fast transactions and low fees, with the stability and trust associated with traditional currencies.

Decentralized Autonomous Organizations (DAOs)

Imagine organizations that run based on pre-set rules encoded as computer programs on a blockchain. DAOs represent a future where companies operate transparently, without hierarchical management, and stakeholders make decisions based on consensus mechanisms.

Enhanced Privacy and Security

With advancements in cryptographic techniques, future blockchains will offer even greater privacy for users. Techniques like zero-knowledge proofs could allow for transactions to be verified without revealing any actual details about them.

Interoperability Between Different Blockchains

As the number of blockchain platforms grows, there’s a need for these systems to communicate and interact seamlessly. The future will likely see the development of “inter-blockchain” communication protocols, allowing for a more interconnected and collaborative blockchain ecosystem.

Sustainability and Eco-friendly Platforms

One of the criticisms of blockchain, particularly public ones like Bitcoin, is their environmental impact due to energy-intensive mining processes. The future will likely see a shift towards more eco-friendly consensus mechanisms, like Proof of Stake or hybrid models, reducing the carbon footprint of blockchain operations.

Conclusion

Blockchain, the revolutionary distributed ledger technology, stands poised to redefine the world of finance. From its inception as the backbone of cryptocurrencies to its transformative potential in ensuring secure, transparent, and efficient transactions, blockchain’s journey has been both remarkable and promising.

As it integrates with traditional banking, paves the way for Central Bank Digital Currencies, and fosters innovations like Decentralized Autonomous Organizations, the future of finance seems intrinsically linked with blockchain’s evolution. Amidst the challenges and criticisms, the technology’s promise to reshape the financial landscape is undeniable, heralding a new era of decentralized, transparent, and inclusive financial systems.

Bitcoinnewsmagazine is committed to providing impartial and reliable insights into cryptocurrency, finance, trading, and stocks. It's important to note that we do not provide financial advice, and we strongly encourage users to conduct their own research and due diligence.

Read More