The evolving landscape of cryptocurrency has revolutionized the global financial system. With each passing day, new digital coins emerge, each with its unique value proposition. As investors become more sophisticated, understanding these new coins becomes imperative for maximizing potential returns and diversifying portfolios effectively. Among the myriad of coins, one stands out for its unique attributes and proposition – the Ripple.

Background of the Ripple

Ripple, more commonly recognized for its digital payment protocol than its cryptocurrency, originated in 2012. The coin, XRP, operates within the Ripple network. Ripple Labs, a San Francisco-based company, is the driving force behind its development, envisioning a system where money can move as quickly as information does today.

Features of the Ripple

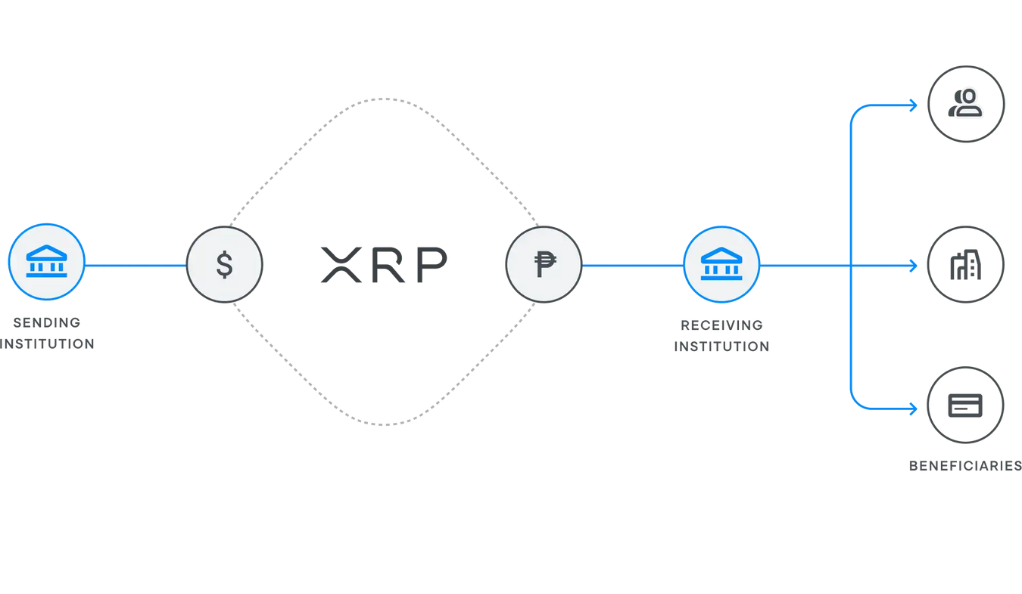

Ripple stands apart due to its digital payment protocol more than its cryptocurrency. Leveraging a distributed consensus mechanism, Ripple doesn’t rely on the energy-intensive proof-of-work used by Bitcoin. This ensures quicker validation of transactions. Moreover, Ripple’s security features are robust, offering secure, instant, and nearly free global transactions of any size with no chargebacks.

Utilities of the Ripple

- Real-time cross-border payments for banks.

- A source of liquidity for real-time forex trading.

- Partnerships with significant banks worldwide, such as Santander and Standard Chartered.

- Differentiates by acting as a bridge currency where trust doesn’t exist.

Market Potentials

With a substantial market cap, Ripple consistently ranks among the top cryptocurrencies. Its historical performance depicts steady growth, attributed to its partnerships with major global banks. Factors influencing its future include its widespread adoption as a global payment system and potential regulatory recognition.

Expert Opinions and Predictions

Brad Garlinghouse, CEO of Ripple, once highlighted the coin’s potential as a liquidity tool for banks. Analysts believe that if Ripple continues its banking collaborations and receives regulatory acceptance, its value could soar. However, like all predictions, it’s rooted in present data, and markets are inherently volatile.

Potential Risks and Challenges

While Ripple has numerous strengths, potential vulnerabilities lie in its centralized nature, making it susceptible to single-point failures. Regulatory challenges are also a concern, with debates about whether XRP should be treated as a security. Additionally, Ripple faces stiff competition from other fast transaction coins and traditional banking systems.

How It Fits in a Diversified Crypto Portfolio

- Diversification: Its unique utility offers a different value proposition from coins like Bitcoin or Ethereum.

- Stability: Partnerships with established financial institutions might offer a level of stability, consider allocating a moderate percentage, given its potential but also its unique challenges.

Conclusion

Ripple, with its unique attributes, has carved a niche in the crypto world. However, as with any investment, it’s crucial for potential investors to conduct diligent research and remain updated on market dynamics.

FAQs

Ripple is both a platform and a currency. The Ripple platform is an open-source protocol designed for fast and cheap digital transactions. XRP, Ripple’s coin, is a tool for the platform, making it more than just a cryptocurrency. Bitcoin, on the other hand, was developed solely as a digital currency.

Banks are drawn to Ripple due to its real-time international payment system, which offers fast, secure, and cheap cross-border transactions. Ripple’s partnerships with significant global banks stand testament to its utility in the banking sector.

Unlike Bitcoin or Ethereum, which are fully decentralized, Ripple walks a middle path. While its XRP Ledger uses a decentralized network of validators, critics argue that Ripple Labs maintains significant control, making it semi-decentralized.

Bitcoinnewsmagazine is committed to providing impartial and reliable insights into cryptocurrency, finance, trading, and stocks. It's important to note that we do not provide financial advice, and we strongly encourage users to conduct their own research and due diligence.

Read More