Chainlink (LINK) has emerged as a cornerstone in the rapidly evolving world of decentralized finance (DeFi) and blockchain technology. As an investor or crypto enthusiast, understanding Chainlink’s foundational principles and its significance in the broader crypto landscape is crucial. This section provides a comprehensive introduction to Chainlink, setting the stage for deeper exploration in subsequent sections.

Understanding Chainlink’s Core Functionality

Chainlink’s rise to prominence in the crypto world is largely attributed to its unique and innovative core functionality. This section aims to unpack the intricacies of how Chainlink operates, ensuring a clear understanding of its pivotal role in the blockchain ecosystem.

Before diving into Chainlink’s specifics, it’s essential to grasp the concept of oracles in the blockchain realm. Oracles are third-party services that provide smart contracts with external information. They serve as bridges between blockchains and the outside world, enabling smart contracts to interact with off-chain data, events, and payments.

Chainlink’s Decentralized Oracle Network

Unlike traditional oracles, which operate on a centralized system, Chainlink introduces a decentralized approach:

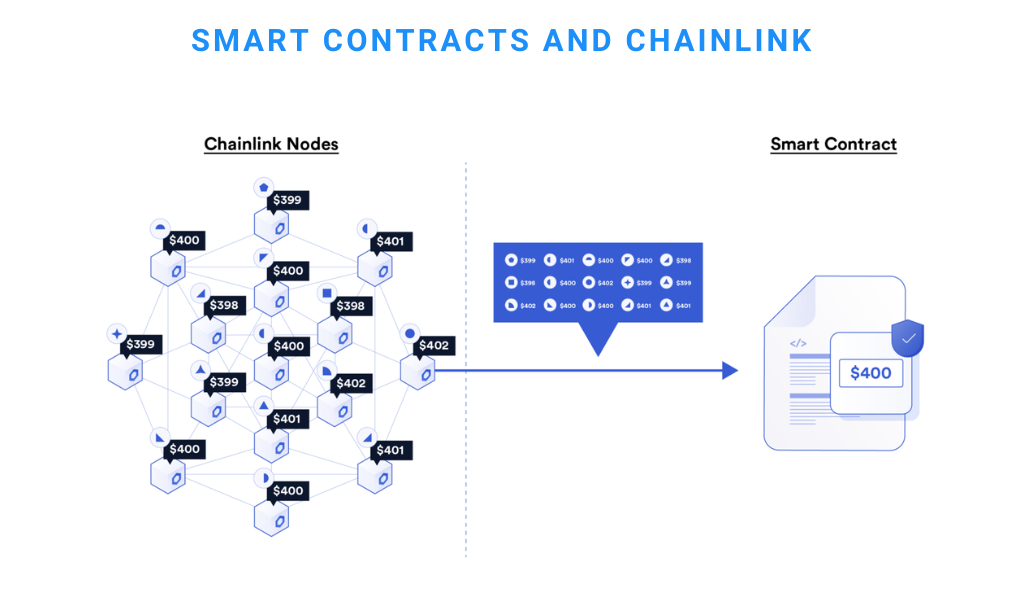

Multiple Node Operators: Chainlink’s network consists of numerous independent node operators. These operators fetch and relay data, ensuring redundancy and reliability.

Data Aggregation: To avoid single points of failure and ensure data accuracy, Chainlink aggregates data from multiple sources. This consensus mechanism ensures that the data fed into smart contracts is trustworthy.

Smart Contracts and Chainlink

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute actions when predefined conditions are met. Chainlink enhances the capabilities of smart contracts by allowing them to:

Access Real-World Data: Whether it’s stock prices, weather updates, or any other external data, Chainlink ensures smart contracts can utilize this information.

Make Decisions Based on External Events: With Chainlink’s oracles, smart contracts can trigger actions based on real-world events, such as releasing funds when a shipment is confirmed.

Chainlink’s Data Reliability Mechanism

Ensuring the reliability of data is paramount. Chainlink employs several mechanisms to guarantee data accuracy:

Multiple Data Sources: Chainlink fetches data from various providers, reducing the risk of any single source being compromised or providing inaccurate data.

Reputation System: Node operators in the Chainlink network are subject to a reputation system. Operators that consistently provide accurate data are rewarded, while those that don’t face penalties.

Chainlink’s Role in Decentralized Finance (DeFi)

DeFi platforms have revolutionized traditional financial systems by eliminating intermediaries. For these platforms to function effectively:

Reliable Financial Data: Chainlink ensures that DeFi platforms receive accurate financial data, such as exchange rates and asset prices.

Automated Loan Agreements: Chainlink’s oracles can trigger loan disbursements based on credit checks from traditional systems, bridging the gap between decentralized and centralized finance.

Historical Performance Analysis

Understanding Chainlink’s past performance is crucial for any investor or enthusiast looking to gauge its potential future trajectory. This section will provide a comprehensive analysis of Chainlink’s historical price movements, significant milestones, and the factors that influenced its market dynamics.

Chainlink’s Inception and Early Days

Chainlink’s journey began with its Initial Coin Offering (ICO) in September 2017. The ICO was a success, raising a significant amount and setting the stage for LINK’s entry into the crypto market.

Initial Price: At its launch, LINK was priced modestly, but it quickly garnered attention due to its unique value proposition in the oracle space.

Milestones and Price Surges

- 2019: Chainlink gained significant traction in 2019, with collaborations like Google Cloud integrating Chainlink’s technology. This year marked its first major price surge.

- 2020: The rise of Decentralized Finance (DeFi) platforms saw Chainlink’s oracles play a pivotal role, leading to increased demand for LINK and subsequent price appreciation.

- 2021: Chainlink reached its all-time high of $US52.70, driven by broader bullish sentiment in the crypto market and Chainlink’s continuous innovations.

Factors Influencing Chainlink’s Price

- Partnerships and Collaborations: Chainlink’s numerous partnerships with blockchain projects and traditional enterprises have often led to positive price movements.

- Market Sentiment: Like all cryptocurrencies, LINK’s price is influenced by overall market sentiment, news, and global economic factors.

- Technical Developments: Announcements related to Chainlink’s platform upgrades, such as the anticipated Chainlink 2.0, have historically impacted its price.

Recent Performance and Current Standing

Chainlink’s LINK token stands at $US13.53. This price reflects a significant decline from its all-time high, indicative of the volatile nature of the crypto market. However, considering Chainlink’s strong product and its role in the blockchain ecosystem, many still view it as a valuable asset with potential for future growth.

Investing in Chainlink: Step-by-Step Guide

Investing in Chainlink (LINK) requires a systematic approach to ensure security, compliance, and optimal decision-making. This section provides a detailed, step-by-step guide for those considering venturing into LINK as an investment.

1. Research and Due Diligence

Before diving into any investment, thorough research is paramount.

- Understand Chainlink: Familiarize yourself with Chainlink’s vision, technology, and role in the crypto ecosystem.

- Analyze the Market: Stay updated with the latest news, trends, and expert analyses related to Chainlink and the broader crypto market.

2. Choose a Reputable Cryptocurrency Exchange

Selecting a trusted platform is crucial for a secure and seamless investment experience.

- Popular Options: Consider platforms such as Coinspot, eToro, or Kraken, among others.

- User Reviews: Check reviews and feedback from other users to gauge the platform’s reliability and user-friendliness.

3. Register and Verify Your Identity

- Sign Up: Register on your chosen platform using a valid email address.

- Identity Verification: Due to regulatory requirements, most platforms will require you to verify your identity. This typically involves uploading a photo ID and possibly additional documents.

4. Secure Your Investments

- Set Up a Crypto Wallet: For enhanced security, consider storing your LINK tokens in a dedicated crypto wallet rather than keeping them on the exchange.

- Wallet Options: There are various wallet options, such as hardware wallets, software wallets, and mobile wallets. Choose one based on your security preferences and usability needs.

5. Fund Your Exchange Account

- Deposit Funds: Log into your chosen exchange and navigate to the deposit section. Deposit your preferred currency, like Australian dollars (AUD), using bank transfers or other accepted payment methods.

- Alternative Currencies: Some platforms might require you to purchase a primary cryptocurrency, like Bitcoin (BTC) or Ethereum (ETH), before buying LINK.

6. Purchase Chainlink (LINK)

- Navigate to Trading: Go to the trading section of the exchange.

- Select Trading Pair: Locate the appropriate trading pair, such as LINK/BTC or LINK/ETH, and specify the amount of LINK you wish to purchase.

- Review and Confirm: Double-check the transaction details and confirm the purchase.

7. Transfer LINK to Your Wallet

For added security, it’s advisable to transfer your LINK tokens from the exchange to your private wallet.

- Initiate Transfer: On the exchange, find the ‘withdraw’ or ‘transfer’ option.

- Enter Wallet Address: Input your wallet’s receiving address, verify the details, and complete the transfer.

8. Monitor and Adjust Your Investment Strategy

- Stay Updated: Regularly check LINK’s value and market dynamics.

- Set Alerts: Use apps or platforms that provide cryptocurrency prices and set up alerts for significant LINK price changes.

- Reassess Regularly: Given the volatile nature of crypto, revisit your investment strategy periodically, adjusting based on market trends and personal financial goals.

Chainlink 2.0: What’s on the Horizon?

Chainlink’s continuous commitment to innovation and improvement is evident in its roadmap for Chainlink 2.0. This section delves into the anticipated updates, enhancements, and the potential impact they might have on the LINK token’s value and the broader crypto ecosystem.

1. Introduction to Chainlink 2.0

Chainlink 2.0 represents the next evolutionary step for the Chainlink decentralized oracle network. It aims to introduce a range of new features, scalability improvements, and enhanced security measures, ensuring Chainlink remains at the forefront of the oracle solution space.

2. Decentralized Meta-Layer

One of the core innovations of Chainlink 2.0 is the introduction of a decentralized meta-layer. This layer will:

- Aggregate Data: Before it reaches the blockchain, ensuring even greater data accuracy and reliability.

- Enhance Scalability: By processing more data off-chain, reducing the load on the main blockchain.

3. Hybrid Smart Contracts

Chainlink 2.0 introduces the concept of hybrid smart contracts, which combine on-chain code with off-chain computation. This approach:

- Expands Capabilities: Allowing smart contracts to perform more complex operations without overloading the blockchain.

- Reduces Costs: By minimizing the on-chain data processing requirements.

4. Enhanced Decentralization and Security

Chainlink 2.0 aims to further decentralize its network by:

- Introducing More Nodes: Increasing the number of independent node operators, ensuring greater data reliability.

- Advanced Cryptographic Techniques: Implementing cutting-edge security measures to protect data integrity and user privacy.

5. Expanded Data Source Integration

With Chainlink 2.0, the network will integrate with an even broader range of data sources, including:

- Traditional Databases: Such as SQL and NoSQL databases.

- IoT Devices: Incorporating real-world sensor data into smart contracts.

- Enterprise Systems: Allowing businesses to seamlessly integrate blockchain solutions into their existing infrastructure.

6. Chainlink’s Keepers

Chainlink 2.0 introduces “Keepers,” which are decentralized services that ensure the proper functioning and maintenance of smart contracts. They:

- Automate Maintenance: By regularly checking and updating smart contract parameters.

- Enhance Reliability: Ensuring smart contracts operate without interruptions.

7. Potential Impact on LINK Token Value

The advancements in Chainlink 2.0 could have several implications for the LINK token:

- Increased Demand: Enhanced features and capabilities might drive more platforms to integrate Chainlink, potentially increasing demand for LINK.

- Staking Opportunities: New features might introduce additional staking or collateral opportunities for LINK holders.

Economic Influences and Chainlink’s Potential

Chainlink’s potential is shaped by various economic factors. This section offers a concise overview of these influences and their implications for Chainlink.

Macro-Economic Landscape

- Inflationary tendencies and global economic stability can sway Chainlink’s appeal and valuation.

Regulatory Environment

- Clear regulations can boost Chainlink’s growth, while restrictive policies might hinder its adoption.

Cryptocurrency Market Dynamics

- Chainlink’s value is influenced by the broader crypto market sentiment and the performance of major cryptocurrencies.

Adoption and Integration

- New partnerships enhance LINK’s demand, while emerging competitors might challenge its market position.

Technological Innovations

- Upgrades like Chainlink 2.0 and continuous innovation can impact LINK’s value proposition.

Supply and Demand Dynamics

- The balance between LINK’s supply and its demand within the Chainlink network directly affects its price.

Investor Behavior

- Speculative trading leads to volatility, while long-term investments can offer stability.

Is Chainlink a Good Investment?

Investing in Chainlink requires weighing its advantages against potential challenges. Here’s a brief overview:

Pros:

- Innovative Technology: Chainlink bridges blockchain with real-world data.

- Strong Partnerships: Collaborations with major entities in crypto and traditional sectors.

- Active Development: Continuous innovation, including the anticipated Chainlink 2.0.

- Growing DeFi Sector: Rising demand for Chainlink’s oracles in the expanding DeFi space.

Cons:

- Market Volatility: LINK, like all cryptocurrencies, faces price fluctuations.

- Regulatory Uncertainty: Evolving crypto regulations can impact Chainlink’s trajectory.

- Emerging Competitors: New oracle solutions might challenge Chainlink’s market position.

- Complexity: Chainlink’s intricate technology might be daunting for some investors.

Considerations:

- Determine your investment horizon and risk tolerance.

- Consider diversifying your portfolio.

Conclusion

Chainlink, with its groundbreaking oracle technology, has carved a unique niche in the crypto landscape. Its ability to bridge the gap between on-chain and off-chain worlds offers immense potential, especially in the burgeoning DeFi sector. However, like all investments, Chainlink comes with its set of challenges, from market volatility to regulatory uncertainties.

As the crypto ecosystem continues to evolve, Chainlink’s role and its LINK token remain subjects of keen interest and scrutiny. Potential investors are encouraged to stay informed, diversify their portfolios, and approach Chainlink with a balanced perspective, weighing its promising prospects against inherent risks.

Bitcoinnewsmagazine is committed to providing impartial and reliable insights into cryptocurrency, finance, trading, and stocks. It's important to note that we do not provide financial advice, and we strongly encourage users to conduct their own research and due diligence.

Read More