Altcoins, short for “alternative coins,” encompass all cryptocurrencies other than Bitcoin. They represent a diverse and rapidly expanding field of digital assets, each designed with specific functionalities, purposes, and innovations. While Bitcoin remains the pioneer and most recognized cryptocurrency, Altcoins have emerged to challenge, complement, and diversify the crypto landscape.

Brief History and Evolution

The Genesis of Altcoins

- 2011: The birth of Altcoins began with Litecoin, which was the first to fork from the Bitcoin blockchain. It aimed to offer faster transaction times and a different hashing algorithm.

- 2013-2015: This period saw a surge in the creation of Altcoins, including Ripple (XRP), Ethereum (ETH), and Dash. Many were created to address perceived limitations in Bitcoin or to offer entirely new functionalities.

- 2016-Present: The explosion of Initial Coin Offerings (ICOs) and the development of various blockchain platforms have led to the creation of thousands of Altcoins, each catering to specific niches and use cases.

Table 1: Comparison of Early Altcoins

| Altcoin | Launch Year | Key Features | Purpose |

|---|---|---|---|

| Litecoin | 2011 | Faster transactions, Scrypt algorithm | Improved version of Bitcoin |

| Ripple (XRP) | 2012 | Real-time settlement system | Facilitate cross-border payments |

| Ethereum | 2015 | Smart contracts, DApps | Decentralized platform |

Purpose of the Article

The rise of Altcoins represents a significant and complex phenomenon in the world of digital finance. With a multitude of coins, each with unique characteristics, understanding the opportunities and risks associated with Altcoins can be a daunting task. This article aims to demystify the world of Altcoins, providing readers with a comprehensive guide to their rise, the opportunities they present, the risks involved, and the future prospects. Whether you are an investor, enthusiast, or newcomer to the crypto space, this article serves as an informative and engaging exploration of the dynamic world of Altcoins.

Diving Deeper

As we proceed, we will delve into various aspects of Altcoins, including their types, the technological innovations they bring, the investment landscape, and the regulatory environment. We will also explore real-world applications and case studies, shedding light on how Altcoins are shaping the future of finance, technology, and society at large.

Understanding Altcoins

What Are Altcoins?

Altcoins, or “alternative coins,” encompass all cryptocurrencies other than Bitcoin. They are called “alternative” because they provide various alternatives to the functionalities, features, or philosophies of Bitcoin. While some Altcoins are mere variations of Bitcoin, others introduce entirely new and groundbreaking technologies.

Types of Altcoins

Altcoins can be broadly categorized into several types based on their intended use and underlying technology. Here’s a detailed look at the main categories:

- Payment Tokens. These are designed to be used as digital currency for transactions. Examples include Litecoin and Bitcoin Cash.

- Stablecoins. Stablecoins aim to reduce volatility by pegging their value to traditional assets like fiat currencies or precious metals. Examples include Tether (USDT) and USD Coin (USDC).

- Security Tokens. These represent ownership in real-world assets, such as stocks or real estate. They are often regulated by financial authorities.

- Utility Tokens. Utility tokens provide access to specific services within a blockchain network. Examples include Ether (ETH) for the Ethereum network.

- Meme Coins. Often created as jokes or for speculative purposes, meme coins can gain rapid popularity. Dogecoin is a well-known example.

- Governance Tokens. These allow holders to participate in decision-making within a blockchain network, influencing changes to protocols or other aspects.

Types of Altcoins

| Type | Example | Purpose |

|---|---|---|

| Payment Tokens | Litecoin | Digital currency for transactions |

| Stablecoins | Tether (USDT) | Reduce volatility by pegging to traditional assets |

| Security Tokens | RealT | Represent ownership in real-world assets |

| Utility Tokens | Ether (ETH) | Access to specific services within a network |

| Meme Coins | Dogecoin | Often created as jokes or for speculative purposes |

| Governance Tokens | Maker (MKR) | Allow participation in decision-making within a network |

Key Differences Between Altcoins and Bitcoin

While Altcoins often share some fundamental characteristics with Bitcoin, they can also differ significantly in various aspects:

- Technology: Some Altcoins use different consensus mechanisms, such as Proof-of-Stake (PoS) instead of Bitcoin’s Proof-of-Work (PoW).

- Functionality: Altcoins like Ethereum introduce functionalities like smart contracts, which are not native to Bitcoin.

- Philosophy: Some Altcoins aim to provide more privacy, energy efficiency, or community governance compared to Bitcoin.

- Economics: Altcoins may have different supply limits, inflation rates, and distribution methods.

The Significance of Altcoins

Altcoins play a crucial role in the diversification and evolution of the cryptocurrency landscape. They drive innovation, offer investment opportunities, and enable new use cases that extend beyond traditional financial systems. From powering decentralized applications to enabling cross-border payments without intermediaries, Altcoins are at the forefront of the blockchain revolution.

The Rise of Altcoins

The Genesis of Altcoins

The journey of Altcoins began with the launch of Litecoin in 2011, which was created as a “lighter” version of Bitcoin. Since then, the Altcoin landscape has expanded exponentially, with thousands of different Altcoins catering to various needs and niches.

Factors Contributing to the Rise

- Technological Innovations. Altcoins have introduced new technologies and consensus mechanisms, such as Proof-of-Stake (PoS), Delegated Proof-of-Stake (DPoS), and more, enhancing efficiency and security.

- Diversification of Use Cases. From decentralized finance (DeFi) to non-fungible tokens (NFTs), Altcoins have enabled a wide array of applications that extend beyond mere currency use.

- Regulatory Acceptance. Some countries have begun to recognize and regulate cryptocurrencies, including Altcoins, boosting investor confidence and adoption.

- Community and Developer Engagement. The rise of Altcoins has been fueled by active community participation and developer innovation, leading to continuous improvement and diversification.

Milestones in the Rise of Altcoins

The rise of Altcoins has been marked by several significant milestones that have shaped the cryptocurrency landscape. The launch of Ethereum in 2015 pioneered the concept of smart contracts and decentralized applications (DApps), with Ether becoming one of the most prominent Altcoins. Following this, the period between 2016 and 2018 saw the ICO boom, leading to the creation of numerous Altcoins as projects raised funds through token sales. This era of innovation continued into 2020 with the explosion of decentralized finance (DeFi) platforms, powered by Altcoins, which saw massive growth and democratized finance and investment. More recently, in 2021, the Altcoin-enabled creation and trading of non-fungible tokens (NFTs) led to a cultural phenomenon in digital art and collectibles. Each of these milestones has contributed to the diversification, popularity, and utility of Altcoins, reflecting their evolving role in the digital economy.

Notable Altcoins and Their Impact

Several Altcoins have made significant impacts on the cryptocurrency landscape. Ethereum, launched in 2015, pioneered the concepts of smart contracts and decentralized applications (DApps), setting a precedent for many subsequent Altcoins. Binance Coin, introduced in 2017, became a leading exchange token, driving the Binance ecosystem and influencing the way exchange-based tokens operate. Cardano, also launched in 2017, introduced a research-driven approach to scalability and sustainability, setting new standards for blockchain development. Solana, known for its high throughput and low transaction costs, emerged in 2020 as a powerful contender in the race for blockchain efficiency. Together, these Altcoins have contributed to the diversification, innovation, and growth of the cryptocurrency space, each leaving a unique imprint on the industry.

Challenges and Controversies

While the rise of Altcoins has been meteoric, it has not been without challenges:

- Volatility: Many Altcoins have experienced extreme price volatility, leading to investor losses.

- Scams and Frauds: The lack of regulation has led to numerous scams, especially during the ICO craze.

- Environmental Concerns: Some Altcoins, like Bitcoin, consume significant energy, raising sustainability questions.

The Current Landscape and Future Prospects

The Altcoin landscape continues to evolve, with new projects, technologies, and use cases emerging regularly. The integration of Altcoins into traditional finance, the development of layer 2 solutions, and the potential for further regulatory clarity are likely to shape the future of Altcoins.

Opportunities in Altcoin Investment

Investing in Altcoins has become an appealing avenue for both individual and institutional investors. Unlike traditional investment assets, Altcoins offer unique opportunities and challenges. This section explores the various opportunities that Altcoin investment presents, along with insights into how to navigate the complex landscape.

Diversification in the Crypto Market

- Broadening Investment Horizons. Altcoins allow investors to diversify their portfolios beyond Bitcoin and traditional assets. With thousands of Altcoins available, investors can explore various sectors, technologies, and use cases.

- Risk Mitigation. Diversification across different Altcoins can help mitigate risks associated with the volatility of individual cryptocurrencies.

Potential for High Returns

- Historical Performance. Some Altcoins have demonstrated remarkable growth, outpacing traditional investments and even Bitcoin in certain periods.

- Emerging Opportunities. New Altcoins and crypto projects often present early investment opportunities that can lead to substantial returns if successful.

Emerging Technologies and Innovations

- Decentralized Finance (DeFi). Altcoins power DeFi platforms, enabling decentralized lending, borrowing, and trading, creating new investment avenues.

- Non-Fungible Tokens (NFTs). Investing in NFTs, enabled by Altcoins, has become a novel way to own and trade digital art and collectibles.

Comparison of Investment Opportunities

Investment opportunities in the financial landscape can be broadly categorized into several distinct areas, each with its unique characteristics and appeal. Traditional Investments encompass assets like stocks, bonds, and real estate, representing well-established and often lower-risk options. Bitcoin, as the first cryptocurrency and often referred to as digital gold, has carved out its unique space in the investment world. Altcoins offer a diverse range of investment opportunities, with various use cases, technologies, and potential returns. They include well-known cryptocurrencies like Ethereum, Litecoin, and Cardano, among others. Decentralized Finance (DeFi) Platforms, powered by Altcoins, have emerged as innovative investment avenues, providing decentralized financial services such as lending, borrowing, and trading through platforms like Uniswap and Aave. Non-Fungible Tokens (NFTs), another Altcoin-enabled innovation, present unique investment opportunities in digital assets, art, and collectibles, with examples like CryptoPunks and NBA Top Shot. Together, these categories illustrate the multifaceted and evolving nature of investment opportunities, each catering to different investor preferences, risk tolerances, and interests.

Considerations and Best Practices

Investing in Altcoins requires careful consideration and adherence to best practices:

- Research: Thoroughly research Altcoins, including their technology, team, use case, and market potential.

- Risk Management: Implement risk management strategies, such as diversifying and setting stop-loss orders.

- Regulatory Compliance: Understand and comply with local regulations related to cryptocurrency investment.

- Professional Guidance: Consider seeking professional financial advice, especially for significant investments.

Conclusion: The Dynamic Landscape of Altcoin Investment

Altcoin investment presents a dynamic and multifaceted opportunity for investors seeking to explore the cutting edge of finance and technology. From diversification and high-return potential to emerging innovations like DeFi and NFTs, Altcoins offer a rich and complex landscape. However, these opportunities come with inherent risks and complexities, requiring informed decision-making and strategic planning.

Risks and Challenges

Investing in Altcoins, while offering numerous opportunities, also comes with its share of risks and challenges. Understanding these is crucial for anyone considering venturing into this dynamic yet complex landscape.

Market Volatility

Altcoins are known for their extreme price volatility. Rapid price fluctuations can occur within short time frames, leading to significant gains but also substantial losses. This volatility can be driven by various factors, including market sentiment, news, regulatory changes, and macroeconomic events.

Security Issues and Fraud

- Hacks and Breaches. Security breaches in exchanges and wallets have led to the loss of millions of dollars worth of Altcoins. Ensuring robust security measures is vital to protect investments.

- Scams and Fraudulent Schemes. The lack of regulation and oversight has led to numerous scams, including Ponzi schemes, pump-and-dump tactics, and fraudulent Initial Coin Offerings (ICOs).

Regulatory Concerns

Regulatory landscapes for cryptocurrencies vary widely across countries and jurisdictions. Some countries have embraced Altcoins, while others have imposed strict regulations or outright bans. Navigating these regulatory complexities requires awareness and compliance with local laws.

Technological Risks

- Network Failures. Altcoins rely on decentralized networks, and any failure or bugs in the network can lead to disruptions and potential losses.

- Obsolescence. With rapid technological advancements, some Altcoins may become obsolete if they fail to innovate and adapt to new industry standards and user needs.

Economic Factors

Economic events such as recessions, inflation, and changes in interest rates can influence the value and adoption of Altcoins. Understanding the interplay between Altcoins and broader economic factors is essential for informed investment decisions.

Lack of Standardized Evaluation Methods

Unlike traditional assets, Altcoins lack standardized evaluation methods. This absence of clear valuation metrics can make it challenging to assess the true value and potential of an Altcoin, leading to speculative investments.

Conclusion: Navigating the Risks and Challenges

Investing in Altcoins requires a nuanced understanding of the associated risks and challenges. From market volatility and security concerns to regulatory complexities and technological risks, the Altcoin landscape is fraught with potential pitfalls. However, with diligent research, risk management, regulatory compliance, and an understanding of the underlying technologies, investors can navigate these challenges and make informed decisions. The dynamic world of Altcoins offers exciting opportunities but demands caution, awareness, and strategic planning.

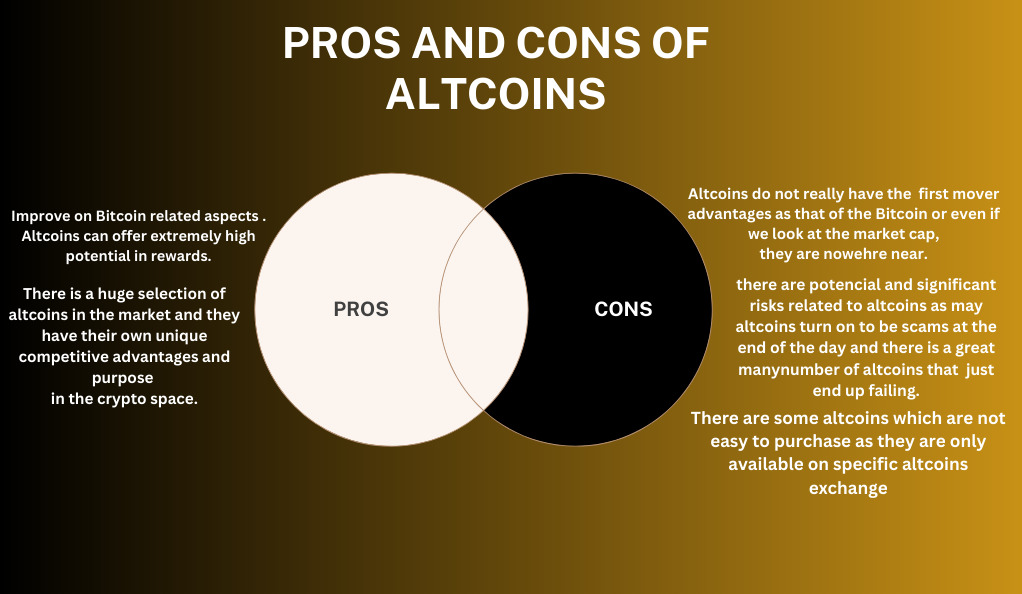

Pros and Cons of Altcoins

Altcoins, representing a diverse array of cryptocurrencies beyond Bitcoin, have brought both exciting opportunities and notable challenges to the crypto landscape. This section delves into the pros and cons of Altcoins, providing a balanced and comprehensive view of their impact and potential.

Pros of Altcoins

Altcoins have brought a wave of technological innovation to the cryptocurrency landscape, introducing features such as smart contracts, scalability solutions, and energy-efficient consensus mechanisms. For example, Altcoins like Ethereum have enabled programmable and automated transactions through smart contracts, while others have reduced transaction times and costs with improved scalability. Some Altcoins even offer more energy-efficient alternatives to Bitcoin’s Proof-of-Work system. Beyond technological advancements, Altcoins present appealing investment opportunities. They allow investors to diversify their portfolios, spreading risk across various assets, and have shown the potential for remarkable growth, providing significant returns on investment in some cases. Altcoins also play a vital role in the democratization of finance. They power Decentralized Finance (DeFi) platforms, democratizing access to financial services, and facilitate cross-border transactions without the need for traditional intermediaries. Together, these pros highlight the transformative impact of Altcoins, showcasing their potential to drive innovation, investment opportunities, and financial inclusivity.

Cons of Altcoins

While Altcoins offer numerous benefits, they also come with their share of drawbacks and challenges. One of the most prominent cons is market volatility, with Altcoins often subject to extreme price fluctuations that can lead to potential financial losses. Security and regulatory risks are also significant concerns. The lack of regulation and robust security measures has led to instances of hacks and fraudulent activities, while the ever-changing regulatory landscape creates uncertainty that can impact the value and legality of certain Altcoins. Technological and economic challenges further complicate the picture. Bugs, network failures, and other technological issues can disrupt Altcoin functionality, and global economic events can influence their value and adoption. Additionally, many Altcoins face challenges related to limited acceptance for goods and services and a lack of standardization in evaluation and rating systems. This absence of standardized metrics can make investment decisions particularly challenging. Together, these cons paint a complex picture of the risks and challenges associated with Altcoins, highlighting the need for caution, due diligence, and a comprehensive understanding of the crypto landscape.

Comparison of Pros and Cons

The pros and cons of Altcoins reflect a complex interplay of technological innovation, investment potential, democratization of finance, market volatility, security risks, and more. While Altcoins offer groundbreaking solutions and investment opportunities, they also present challenges related to volatility, security, regulation, and adoption.

Conclusion: The Multifaceted World of Altcoins

Altcoins represent a multifaceted and dynamic aspect of the cryptocurrency world. They have introduced innovative technologies, democratized finance, and created new investment avenues. However, these benefits are accompanied by significant challenges, including market volatility, security concerns, and regulatory uncertainties. Understanding the pros and cons of Altcoins is essential for investors, developers, regulators, and users to make informed decisions and navigate the ever-evolving crypto landscape.

Future of Altcoins

The future of Altcoins is a subject of intense interest and speculation, reflecting the dynamic and rapidly evolving nature of the cryptocurrency landscape. This section explores the potential future directions, trends, challenges, and opportunities that may shape the trajectory of Altcoins in the coming years.

Technological Advancements

The continuous innovation in blockchain technology is likely to drive the future of Altcoins. Key areas of focus include:

- Scalability Solutions: Efforts to enhance transaction speed and reduce costs will continue to be a priority.

- Energy Efficiency: The development of more sustainable consensus mechanisms will address environmental concerns.

- Interoperability: Enabling seamless interaction between different blockchain networks will foster a more cohesive ecosystem.

Regulatory Landscape

The regulatory environment will play a crucial role in shaping the future of Altcoins:

- Clearer Regulations: The establishment of clear and consistent regulations across jurisdictions may boost investor confidence and adoption.

- Compliance Challenges: Stricter regulations may pose challenges for some Altcoins, requiring adaptation and compliance efforts.

Investment and Adoption Trends

Investment and adoption patterns will significantly influence the future trajectory of Altcoins:

- Institutional Investment: Increased participation from institutional investors may bring stability and growth to the Altcoin market.

- Mainstream Adoption: Broader acceptance of Altcoins for payments, remittances, and other use cases will enhance their utility and value.

Emerging Use Cases

New and innovative use cases for Altcoins will continue to emerge, expanding their impact and relevance:

- Decentralized Finance (DeFi): The expansion of DeFi platforms and services will likely continue, powered by Altcoins.

- Non-Fungible Tokens (NFTs): The integration of Altcoins with NFTs may lead to new opportunities in digital art, gaming, and collectibles.

- Supply Chain Management: Altcoins may play a role in enhancing transparency and efficiency in supply chain processes.

Challenges and Risks

The future of Altcoins is not without potential challenges and risks:

- Market Volatility: Continued price volatility may deter some investors and users.

- Security Concerns: Ongoing efforts to enhance security will be vital to protect against hacks and fraud.

- Competitive Landscape: The proliferation of Altcoins may lead to increased competition, with some projects potentially becoming obsolete.

Conclusion: A Dynamic and Uncertain Future

The future of Altcoins is both exciting and uncertain, marked by continuous innovation, regulatory developments, investment trends, emerging use cases, and inherent challenges. The ability of Altcoins to adapt, innovate, and navigate the complex landscape will determine their long-term success and relevance. Investors, developers, regulators, and users must remain vigilant, informed, and adaptable to seize opportunities and mitigate risks in this ever-changing domain.

Investment Strategies and Recommendations

Investing in Altcoins requires a strategic approach, grounded in research, analysis, and a clear understanding of the unique characteristics and risks associated with this asset class. This section provides insights into investment strategies and recommendations for those considering or actively engaged in Altcoin investment.

Understanding the Altcoin Landscape

Investors must begin by understanding the diverse and complex landscape of Altcoins:

- Research Individual Altcoins: Analyze the technology, team, use case, market potential, and competitive landscape of specific Altcoins.

- Assess Market Trends: Monitor market trends, news, and regulatory developments that may impact Altcoin value and adoption.

Diversification and Risk Management

Diversification and risk management are essential components of a successful investment strategy:

- Diversify the Portfolio: Spread investments across different Altcoins to mitigate the risk associated with individual assets.

- Implement Risk Management Tools: Utilize tools such as stop-loss orders and position sizing to manage potential losses.

Long-Term vs. Short-Term Investment

Investors must align their investment approach with their financial goals and risk tolerance:

- Long-Term Investment: Consider a long-term approach for Altcoins with strong fundamentals and growth potential.

- Short-Term Trading: Engage in short-term trading for opportunities based on market trends and technical analysis.

Compliance and Regulatory Considerations

Compliance with local regulations is crucial to avoid legal complications:

- Understand Local Regulations: Familiarize yourself with the legal and tax implications of Altcoin investment in your jurisdiction.

- Seek Professional Guidance: Consider consulting with legal and financial professionals to ensure compliance.

Utilizing Professional Investment Platforms

Choosing the right platforms and tools can enhance investment success:

- Select Reputable Exchanges: Utilize well-known and regulated exchanges for buying, selling, and trading Altcoins.

- Consider Investment Funds: Explore cryptocurrency investment funds that specialize in Altcoins for professional management.

Staying Informed and Adaptable

The dynamic nature of the Altcoin market requires ongoing vigilance:

- Stay Informed: Regularly monitor news, market analysis, and community discussions to stay abreast of developments.

- Remain Adaptable: Be prepared to adjust investment strategies in response to market changes and emerging opportunities.

Conclusion: A Thoughtful and Strategic Approach

Investing in Altcoins demands a thoughtful and strategic approach, encompassing research, diversification, risk management, compliance, platform selection, and adaptability. By following these guidelines and aligning investment strategies with individual goals, risk tolerance, and market dynamics, investors can navigate the complex world of Altcoins with greater confidence and success.

Conclusion

The exploration of Altcoins in this article has traversed a multifaceted landscape, uncovering the technological innovations, investment opportunities, risks, challenges, future prospects, and strategic considerations that define this dynamic domain.

Recapitulation of Key Insights

- Technological Innovations: Altcoins have driven significant technological advancements, including smart contracts, scalability solutions, and energy efficiency.

- Investment Landscape: The investment opportunities in Altcoins are diverse, offering potential for high returns, diversification, and access to emerging trends like DeFi and NFTs.

- Risks and Challenges: The complexities of market volatility, security concerns, regulatory uncertainties, and technological risks underscore the need for caution and due diligence.

- Future Prospects: The future of Altcoins is marked by continuous innovation, regulatory developments, investment trends, and emerging use cases, pointing to a dynamic and uncertain path ahead.

- Investment Strategies: Successful investment in Altcoins requires a thoughtful and strategic approach, encompassing research, risk management, compliance, and adaptability.

Reflection on the Broader Impact

Altcoins represent more than just an investment asset or technological innovation. They are part of a broader movement towards decentralization, democratization of finance, and the creation of new economic models. Their impact extends beyond financial markets, influencing technology, governance, culture, and society.

Considerations for Stakeholders

Different stakeholders, including investors, developers, regulators, and users, must approach Altcoins with a nuanced understanding:

- Investors: Must align strategies with individual goals, risk tolerance, and market dynamics.

- Developers: Should focus on innovation, security, and user-centric design.

- Regulators: Need to balance innovation with consumer protection and legal compliance.

- Users: Should educate themselves about the functionality, risks, and benefits of Altcoins.

Final Thoughts: A Complex and Evolving Landscape

The world of Altcoins is complex, evolving, and filled with both opportunities and challenges. It offers a glimpse into the future of finance, technology, and society, reflecting a convergence of innovation, risk, potential, and uncertainty. Navigating this landscape requires knowledge, vigilance, strategic thinking, and an openness to continuous learning and adaptation. The journey into Altcoins is not a simple or linear path, but a multifaceted exploration that demands a comprehensive and thoughtful approach.

Bitcoinnewsmagazine is committed to providing impartial and reliable insights into cryptocurrency, finance, trading, and stocks. It's important to note that we do not provide financial advice, and we strongly encourage users to conduct their own research and due diligence.

Read More