Bitcoin, often referred to as digital gold, is a decentralized cryptocurrency. It was created in 2009 by an anonymous entity known as Satoshi Nakamoto. Unlike traditional currencies issued by governments (also known as fiat currencies), Bitcoin operates on a technology called blockchain. This digital ledger records all transactions made with Bitcoin, offering transparency and security.

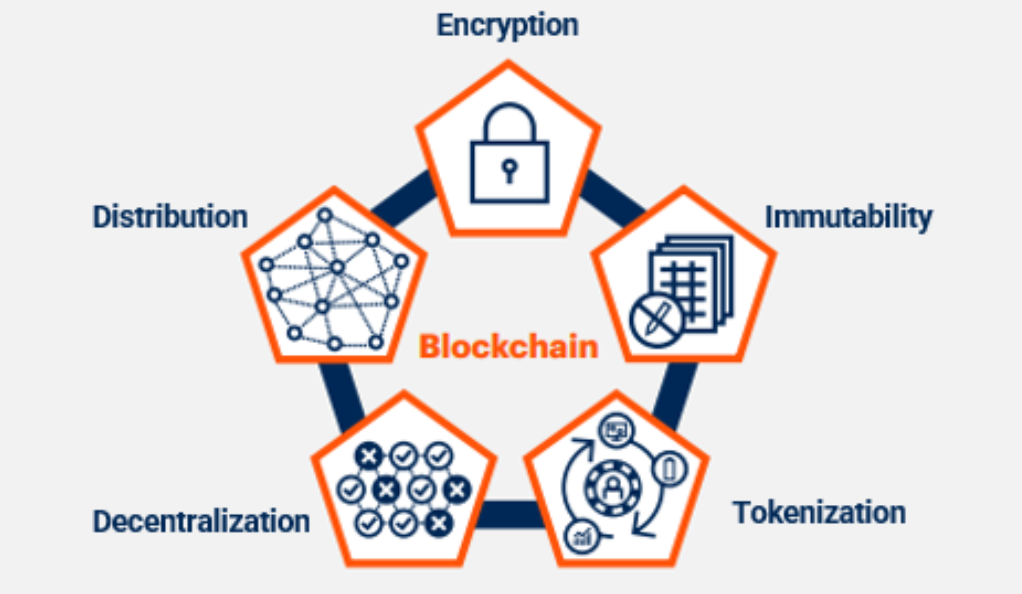

The process of creating new bitcoins and confirming transactions on the blockchain is known as mining. This involves solving complex mathematical problems and requires substantial computational power. The decentralized nature of Bitcoin means that it’s not controlled by any institution or government. This fundamental characteristic has significant implications for the global financial landscape, sparking discussions about the future of money.

Getting Started with Bitcoin

To start using Bitcoin, one first needs to set up a Bitcoin wallet. This is a digital storage system for your cryptocurrency. Wallets can be software-based (on your computer or smartphone) or hardware devices that store Bitcoin offline. Each wallet has a unique address, similar to how an email works.

Bitcoins can be bought on various exchanges using traditional currency. These exchanges operate similarly to stock exchanges, allowing users to buy, sell, and trade Bitcoin based on market prices. It’s important to understand how these platforms work and to consider their security measures. Protecting your investments and personal information is crucial in the world of digital currencies, especially given the number of high-profile hacks and scams in recent years.

Storing Bitcoin Securely

There are two main types of wallets for storing Bitcoin: hot wallets and cold wallets. Hot wallets are connected to the internet and provide ease of access but are vulnerable to hacking. Cold wallets, on the other hand, are offline storage systems, making them more secure. Hardware wallets are a type of cold wallet, while software wallets can be installed on your computer or smartphone.

Regardless of the type of wallet you choose, it’s essential to follow best practices to secure your Bitcoin holdings. These include regularly updating your wallet software, using strong passwords, enabling two-factor authentication, and never sharing your private keys. It’s also recommended to keep only a small amount of Bitcoin in hot wallets for daily use and store the rest in a secure cold wallet.

Beyond Digital Gold: Bitcoin’s Utility

While Bitcoin is often viewed as a store of value, similar to gold, it also has utility as a medium of exchange. Its decentralized nature makes it ideal for cross-border transactions, reducing the need for intermediaries and lowering transaction costs. Furthermore, its underlying technology, blockchain, enables the creation of smart contracts. These are self-executing contracts with the terms directly written into code, paving the way for programmable money.

Bitcoin is also increasingly being adopted by businesses as a form of payment. From travel agencies to coffee shops, companies around the world are beginning to accept Bitcoin, contributing to its legitimacy and adoption. At the same time, Bitcoin is playing a significant role in remittances, providing a cheaper and faster alternative to traditional methods of sending money across borders.

Bitcoin and Decentralization

Bitcoin embodies the philosophy of decentralization. It operates outside the control of any government or central authority. This independence from traditional systems allows for greater privacy, reduced censorship, and increased inclusivity. However, it also presents potential challenges and regulatory considerations.

Decentralization also means that Bitcoin is resistant to censorship and government control. Transactions cannot be blocked, and accounts cannot be frozen, as is possible in traditional banking systems. This makes Bitcoin particularly attractive in countries with unstable economies or where the government exerts a high level of control over financial transactions. However, this lack of oversight also raises concerns about illegal activities, such as money laundering or financing terrorism.

Investing and Trading Bitcoin

Investing in Bitcoin can involve long-term holding or active trading. Long-term holding, also known as “HODLing” in the crypto community (based on a misspelling of “hold”), is a strategy where investors buy Bitcoin and hold onto it for a long period, regardless of market fluctuations. This strategy is based on the belief in Bitcoin’s long-term value growth.

Active trading, on the other hand, involves buying and selling Bitcoin on short-term price movements. Traders use various techniques, such as technical analysis and chart patterns, to predict market trends. However, trading is riskier than investing and requires a good understanding of the market. It’s also important to be aware of the risks and rewards associated with trading Bitcoin. As with any investment, there’s no guarantee of profit, and investors should only invest what they can afford to lose.

Innovations and Developments in the Bitcoin Ecosystem

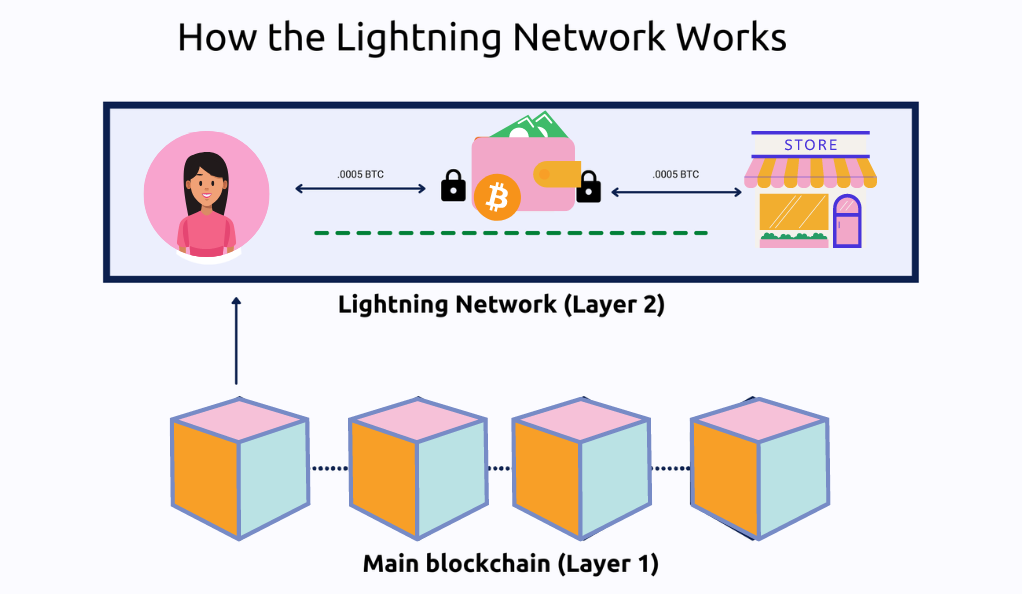

The Bitcoin ecosystem continues to evolve. Innovations such as the Lightning Network aim to address scalability issues, allowing for faster and cheaper transactions. This solution involves creating “off-chain” payment channels that only rely on the underlying blockchain to open and close the channels, reducing network congestion.

Bitcoin’s role in decentralized finance (DeFi) is expanding. DeFi applications aim to recreate traditional financial systems (like lending and borrowing) in a decentralized manner, using cryptocurrencies. Bitcoin is being integrated into DeFi platforms via wrapped tokens – Bitcoin tokenized on other blockchains. Additionally, Bitcoin’s integration with technologies like Internet of Things (IoT) is opening up new possibilities, such as smart devices that can transact independently using Bitcoin.

The Societal and Global Implications of Bitcoin

Bitcoin has the potential to impact financial inclusion significantly. By allowing peer-to-peer transactions without the need for a bank account, Bitcoin can provide financial services to the unbanked population, particularly in developing countries. This could empower millions of people by giving them control over their own money and providing access to global markets.

However, Bitcoin also raises environmental concerns due to the energy consumption associated with mining. Critics argue that the electricity used in mining – which often comes from non-renewable sources – contributes to environmental degradation. On the other hand, proponents suggest that Bitcoin mining incentivizes renewable energy development by creating a demand for cheap, surplus electricity.

Navigating Risks and Challenges

The world of Bitcoin comes with its own set of risks and challenges. Security is a significant concern. Users must protect their wallets from hacking attempts and be vigilant against phishing scams. Avoiding shady exchanges and sticking to reputable platforms can help mitigate these risks.

Legal and regulatory challenges also exist. Different countries have different regulations regarding Bitcoin, ranging from acceptance and taxation to outright bans. Staying updated with the legal environment in your country is crucial. Privacy is another concern. While Bitcoin transactions are pseudonymous (not directly linked to real-world identities), they are still traceable on the blockchain. Users seeking privacy need to be aware of this aspect.

The Future of Bitcoin and Cryptocurrency

The future of Bitcoin is speculative, but its potential to reshape the financial landscape is undeniable. Some believe Bitcoin could become a global reserve currency, while others see it as a digital version of gold – a secure store of value. However, Bitcoin’s future will undoubtedly be shaped by regulatory decisions, technological advancements, and market dynamics.

The broader cryptocurrency landscape is also evolving rapidly, with thousands of other cryptocurrencies (known as altcoins) offering unique features and capabilities. As the sector matures, diversification across different cryptocurrencies may become an important strategy for mitigating risk and maximizing returns.

Conclusion

Bitcoin, as the first and most well-known cryptocurrency, has revolutionized the way we think about money. It has introduced a decentralized model that operates independently of traditional financial systems, offering potential for increased privacy, reduced censorship, and global inclusivity.

Despite its potential, Bitcoin also comes with significant challenges and risks. These include security concerns, regulatory uncertainties, and environmental issues related to energy consumption. Navigating these challenges requires a deep understanding of the cryptocurrency landscape and a cautious approach to investing and trading.

The future of Bitcoin and the broader cryptocurrency industry remains speculative, but it’s clear that digital currencies are here to stay. As the sector continues to evolve, it offers exciting opportunities for innovation, investment, and the potential reshaping of our financial systems. Users, investors, and observers alike need to stay informed and adapt to this rapidly changing landscape.

In conclusion, Bitcoin represents more than just a digital asset; it signifies a shift towards a future where financial control is decentralized and in the hands of the users. Its impact on society is still unfolding, and its full potential remains to be seen. Regardless of what the future holds, Bitcoin has already made a lasting imprint on the world of finance and beyond.

FAQs

Bitcoin is a decentralized digital currency, created in 2009 by an unknown person using the alias Satoshi Nakamoto. It operates on a technology called blockchain which acts as a public ledger containing all transaction data from anyone using bitcoin. Transactions are added to “blocks” or the links of code that make up the chain, and each transaction must be recorded on a block. Bitcoin is not issued or backed by any banks or governments, nor is an individual bitcoin valuable as a commodity. The value of Bitcoin is derived solely from people’s perception of its value.

To start using Bitcoin, you first need to create a Bitcoin wallet. This can be a software-based wallet installed on your computer or smartphone, or a hardware wallet which is a physical device that securely stores your Bitcoin offline. Once you have a wallet, you can purchase Bitcoin from various exchanges using traditional currency or other cryptocurrencies. After purchasing, your Bitcoin will be transferred to your wallet’s address. You can also receive Bitcoin by providing your wallet’s address to those sending you payment.

Bitcoin itself is very secure thanks to the blockchain technology it uses. However, security risks exist in the storage and management of Bitcoin. For instance, if your Bitcoin wallet is not properly secured, hackers may gain access and steal your funds. That’s why it’s essential to use strong passwords, enable two-factor authentication, and keep your wallet software updated. If possible, storing most of your Bitcoin in a cold (offline) wallet and only a small amount in a hot (online) wallet for daily transactions can add an extra layer of security.

Bitcoinnewsmagazine is committed to providing impartial and reliable insights into cryptocurrency, finance, trading, and stocks. It's important to note that we do not provide financial advice, and we strongly encourage users to conduct their own research and due diligence.

Read More