The world of Bitcoin is vast and intriguing. As we delve into its intricacies, we’ll uncover the mechanisms behind wallets, exchanges, and the foundational principles that make this digital currency a revolutionary financial tool.

Bitcoin, often termed a cryptocurrency, is a decentralized digital currency that operates without a central bank or single administrator. Transactions are verified by network nodes through cryptography and chronicled on a public ledger known as a blockchain. Imagine a digital gold, but instead of being stored in a physical vault, it’s stored on a digital ledger. This innovative approach to currency has garnered attention worldwide, making Bitcoin a household name in financial discussions.

Why is Bitcoin Important

In an era where trust in traditional banking systems is dwindling, Bitcoin offers a refreshing alternative. Its decentralized nature means no single entity has control over it. Furthermore, its transparent nature ensures every transaction is open for verification. Think of Bitcoin as a vast, open book where every transaction is visible, but the identities are coded in a secret language. This transparency combined with security makes Bitcoin a formidable player in the financial world.

Understanding Bitcoin Wallets

Types of Bitcoin Wallets

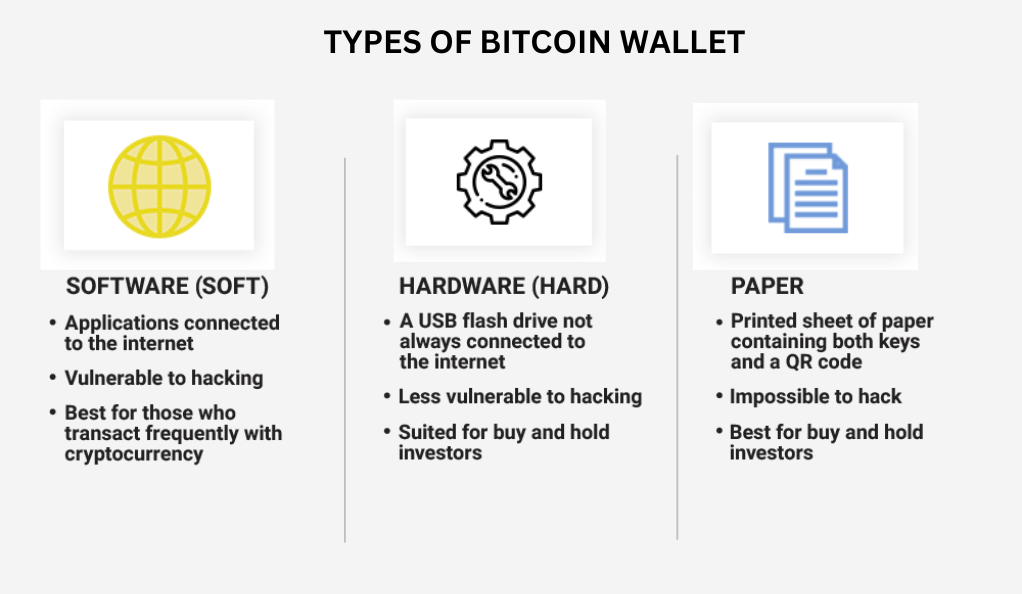

Just as you store your physical cash in a wallet, Bitcoin requires a digital counterpart. However, the digital realm offers a variety of wallet types.

- Hardware Wallets

These are tangible devices, akin to USB drives, that house your private keys. Envision them as a high-tech vault for your Bitcoin. Immune to most digital threats, they stand as one of the safest options for long-term storage. However, like any physical item, they can be lost or damaged, so it’s crucial to handle them with care. - Software Wallets

These are applications or software installed on devices like computers or smartphones. They’re the digital equivalent of your everyday wallet convenient for frequent transactions but susceptible to digital threats. Regular updates and strong passwords are essential to ensure their security. - Paper Wallets

A seemingly archaic method in the digital age, paper wallets are physical documents containing your Bitcoin address and private key. It’s like having a bank check, but for digital currency. While they’re immune to online hacks, they’re vulnerable to physical damages like water, fire, or simple wear and tear.

Diving into Bitcoin Exchanges

What are Bitcoin Exchanges?

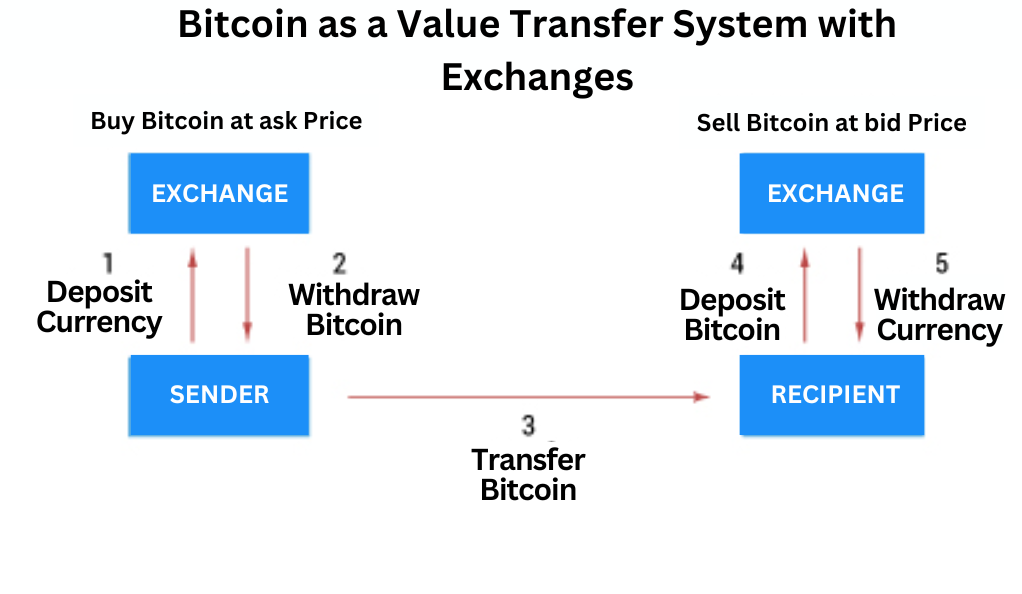

Bitcoin exchanges are platforms facilitating the buying, selling, or trading of Bitcoin. Picture a bustling stock market, but instead of stocks, you’re dealing with digital currency. These platforms are essential for anyone looking to convert their Bitcoin into traditional currency or vice versa.

Choosing the Right Exchange

With a plethora of exchanges available, making the right choice can be daunting. Some prioritize security, while others focus on user-friendliness. It’s akin to choosing between a high-security bank and a local, convenient money changer. Thorough research, user reviews, and security measures are crucial when selecting an exchange.

Principles of Digital Currency

- Decentralization

Central to Bitcoin’s design is the principle of decentralization. Instead of a central authority, it’s upheld by a network of computers. This decentralization ensures that no single entity can control or manipulate the currency, making it resistant to censorship and interference. - Transparency and Security

Every Bitcoin transaction is etched onto the blockchain, ensuring transparency. It’s akin to a transparent vault everyone can see its contents, but only those with the key can access it. This transparency, combined with top-notch security measures, ensures that Bitcoin remains both open and secure. - Finite Supply

Unlike traditional currencies, which can be printed based on economic needs, Bitcoin has a cap. Only 21 million Bitcoins will ever exist. This scarcity is reminiscent of precious metals like gold, ensuring that Bitcoin’s value isn’t diluted by an endless supply.

Conclusion

Bitcoin, with its unique principles and mechanisms, has redefined our understanding of money. As we transition into an increasingly digital age, Bitcoin stands as a beacon, showcasing the potential and promise of digital currencies. Whether you’re a seasoned investor or a curious onlooker, understanding Bitcoin’s workings is crucial in today’s financial landscape.

FAQs

Only 21 million Bitcoins will ever be in existence.

While transactions are transparent on the blockchain, the identities of participants are encrypted, ensuring privacy.

Yes, if you misplace access to your wallet or become a scam victim, your Bitcoins can be lost.

Bitcoin’s legality varies across countries. Always consult local regulations before engaging in Bitcoin activities.

Employing hardware wallets, activating two-factor authentication, and routinely backing up your wallet are pivotal for security.

Bitcoinnewsmagazine is committed to providing impartial and reliable insights into cryptocurrency, finance, trading, and stocks. It's important to note that we do not provide financial advice, and we strongly encourage users to conduct their own research and due diligence.

Read More