Are you intrigued by the world of cryptocurrencies and want to explore the fascinating realm of Bitcoin? Look no further! In this comprehensive guide, we will take you through the fundamental concepts and practical aspects of Bitcoin, helping you unlock the mysteries of this revolutionary digital currency.

In a world rapidly transitioning to digital innovations, Bitcoin stands out as a pioneer in the realm of digital currencies. Created by an anonymous person or group using the pseudonym Satoshi Nakamoto, Bitcoin was introduced in 2009 as open-source software. Its primary goal was to create a decentralized currency that could operate without the need for intermediaries like banks.

Bitcoin operates on a peer-to-peer network, allowing users to send and receive digital payments directly without involving financial institutions. Transactions are verified by network nodes through cryptography and recorded on a public ledger known as the blockchain. This revolutionary approach to currency and transactions has given rise to an entirely new way of conducting financial activities.

How Does Bitcoin Work?

At its core, Bitcoin relies on blockchain technology to operate. Blockchain is a distributed, immutable ledger that records all transactions in a secure and transparent manner. Each transaction is grouped into a block, which is then added to the chain. The process of adding blocks to the blockchain is known as mining. Miners use powerful computers to solve complex mathematical puzzles, and the first one to solve it gets to add the block and is rewarded with newly minted Bitcoin and transaction fees.

Bitcoin’s limited supply is a fundamental aspect of its design. There will only ever be 21 million Bitcoins in existence, making it a deflationary currency. This scarcity is intended to prevent inflation and ensure the value of Bitcoin over time. This unique feature sets it apart from traditional fiat currencies that can be printed in unlimited quantities.

The Blockchain Technology Behind Bitcoin

Central to Bitcoin’s functionality is blockchain technology. The blockchain is a distributed and immutable ledger that records all transactions in a secure and transparent manner. Each block in the chain contains a set of transactions, and once added, they cannot be altered, ensuring the integrity of the entire system.

Blockchain’s decentralized nature eliminates the need for intermediaries, such as banks or payment processors, making transactions faster and cheaper. The consensus mechanism used in blockchain ensures that all network participants agree on the validity of transactions, adding an extra layer of security. This technology has far-reaching implications beyond cryptocurrencies, with potential applications in supply chain management, voting systems, and more.

Obtaining and Storing Bitcoin

To enter the world of Bitcoin, you need a digital wallet to store and manage your holdings. These wallets can be software-based (hot wallets) or hardware devices (cold wallets) that offer varying degrees of security. Hot wallets are connected to the internet and are convenient for daily transactions, while cold wallets are offline and provide enhanced protection against hacking.

You can obtain Bitcoin through various methods, such as purchasing them on cryptocurrency exchanges, receiving them as payment for goods and services, or even mining. Mining, however, has become increasingly resource-intensive and may not be practical for individual miners. Cryptocurrency exchanges allow you to buy Bitcoin using traditional currency, but it’s essential to choose a reputable exchange and secure your holdings in your wallet.

Bitcoin Mining Explained

Bitcoin mining plays a pivotal role in the creation and verification of transactions. Miners use powerful computers to solve complex mathematical puzzles, and the first one to solve it adds a new block to the blockchain. Mining is resource-intensive and is rewarded with newly minted Bitcoin and transaction fees.

The mining process serves two primary purposes: confirming transactions and introducing new Bitcoin into circulation. As transactions are conducted on the Bitcoin network, they are grouped into blocks by miners. These blocks are then added to the blockchain, ensuring the validity and immutability of the transaction history.

Mining also serves as a way to regulate the creation of new Bitcoin. The network is designed to release a predetermined number of new Bitcoins at regular intervals, gradually reducing the issuance over time. This controlled supply schedule is an essential aspect of Bitcoin’s economic model and contributes to its deflationary nature.

Security Measures for Bitcoin Transactions

As with any digital asset, security is paramount when dealing with Bitcoin. Utilizing secure wallets, two-factor authentication, and practicing cautious online behavior are crucial to safeguarding your Bitcoin holdings from potential threats.

When setting up a Bitcoin wallet, it’s essential to choose a reputable provider with a strong track record of security. Cold wallets, such as hardware wallets, offer an added layer of protection by keeping your private keys offline and away from potential hackers. Two-factor authentication adds an extra level of security by requiring a second form of verification, typically through a mobile app or email, when accessing your wallet.

Additionally, staying informed about the latest security practices and being cautious of phishing attempts and suspicious links can help prevent unauthorized access to your Bitcoin. Remember that transactions on the Bitcoin network are irreversible, so taking proactive measures to protect your holdings is essential.

Advantages and Disadvantages of Bitcoin

Bitcoin offers several advantages, such as borderless transactions, lower fees, and potential for investment growth. However, it also faces challenges like price volatility and regulatory uncertainties, making it essential for users to weigh the pros and cons carefully.

Advantages:

- Borderless Transactions: Bitcoin allows for seamless cross-border transactions without the need for currency conversion or intermediaries, making it ideal for international commerce.

- Lower Transaction Fees: Compared to traditional banking and payment systems, Bitcoin transactions typically involve lower fees, especially for large transfers.

- Decentralization: Bitcoin operates on a decentralized network, reducing the control of central authorities and providing users with more financial autonomy.

Disadvantages:

- Price Volatility: Bitcoin’s value is known for its significant fluctuations, which can lead to both substantial gains and losses for investors.

- Regulatory Uncertainty: The regulatory landscape for Bitcoin varies by country and is constantly evolving, creating uncertainties for users and investors.

- Limited Acceptance: While acceptance of Bitcoin is growing, it is not universally recognized as a form of payment, limiting its use in certain industries and regions.

Regulatory Landscape and Future Outlook

The regulatory landscape for cryptocurrencies is continually evolving. Governments around the world are grappling with how to categorize and regulate Bitcoin. Its future remains promising as more institutions and individuals recognize its value and potential.

The approach to regulating Bitcoin varies from country to country. Some nations have embraced cryptocurrencies and blockchain technology, recognizing their potential for economic growth and innovation. Others have taken a more cautious stance, raising concerns about money laundering, tax evasion, and consumer protection.

Despite these challenges, the overall trajectory of Bitcoin’s adoption and acceptance is positive. Major financial institutions, including investment firms and banks, are showing increasing interest in Bitcoin and other cryptocurrencies. As more businesses and individuals become educated about its benefits and risks, the global recognition of Bitcoin as a legitimate and valuable asset class is likely to continue growing.

Investing in Bitcoin: Tips and Strategies

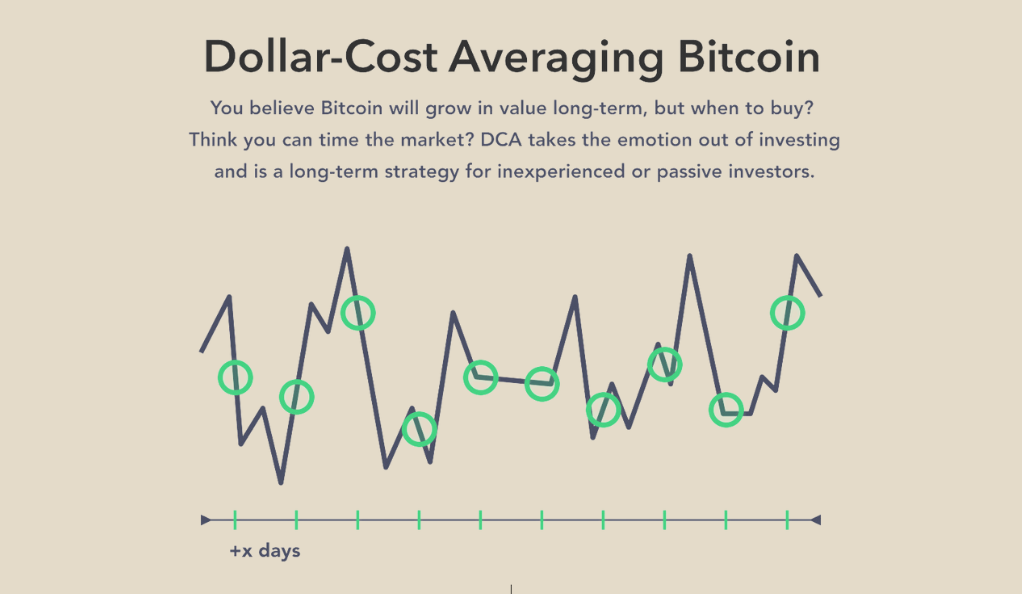

For those interested in investing in Bitcoin, it’s essential to conduct thorough research and develop a clear strategy. Dollar-cost averaging, understanding market trends, and diversifying your portfolio are strategies that can help mitigate risks and optimize your investment.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of its price. This strategy helps reduce the impact of market volatility on your investment.

- Stay Informed: Keeping up with the latest news and trends in the cryptocurrency market can provide valuable insights into potential price movements and market sentiment.

- Diversify Your Portfolio: While Bitcoin has significant potential, it’s essential to diversify your investment portfolio to spread risk across different assets.

- Long-Term Perspective: Bitcoin’s value has shown long-term growth, so consider holding onto your investment for an extended period to potentially reap the benefits of its appreciation.

- Risk Management: Only invest what you can afford to lose. Cryptocurrency markets can be highly volatile, and it’s crucial to avoid overextending yourself financially.

Common Misconceptions about Bitcoin

Bitcoin has garnered its fair share of misconceptions. Addressing these myths can provide a clearer understanding of its true nature and potential.

- Anonymous Transactions: While Bitcoin transactions are pseudonymous, meaning they are not directly tied to individuals’ identities, they are recorded on a public ledger, making them traceable.

- Inherent Untraceability: While Bitcoin transactions are difficult to trace directly, sophisticated blockchain analysis tools can potentially link transactions to specific individuals.

- Used Exclusively for Illegal Activities: While Bitcoin has been associated with illegal transactions in the past, its legitimate use cases are expanding, including remittances, micropayments, and online purchases.

- Unregulated and Unsafe: While Bitcoin operates on a decentralized network, it is subject to various regulatory frameworks in different countries, contributing to its overall legitimacy.

- Too Late to Invest: While Bitcoin’s price has experienced significant growth, it’s still relatively early in the adoption curve, and there may still be opportunities for investment.

Integrating Bitcoin into Everyday Life

While often seen as a speculative investment, Bitcoin can also be used in practical ways. From online merchants accepting Bitcoin payments to remittance services and charitable donations, Bitcoin’s use cases are expanding.

- Online Payments: An increasing number of online retailers and service providers accept Bitcoin as a form of payment, giving users the option to make purchases using their cryptocurrency holdings.

- Remittance Services: Bitcoin can facilitate cross-border remittances, allowing individuals to send funds to family members or friends in different countries quickly and with lower fees compared to traditional methods.

- Charitable Donations: Some charitable organizations accept Bitcoin donations, providing an efficient and transparent way for individuals to support causes they believe in.

- Travel and Hospitality: Certain travel agencies and hospitality providers accept Bitcoin for booking flights, accommodations, and other travel-related services.

- Peer-to-Peer Transactions: Bitcoin’s peer-to-peer nature enables individuals to conduct transactions directly with one another, making it a viable option for buying and selling goods and services locally.

Exploring Alternative Cryptocurrencies

While Bitcoin may have been the pioneer, numerous other cryptocurrencies (altcoins) have emerged since its inception. Ethereum, Litecoin, and Ripple are just a few examples of alternative cryptocurrencies with unique features and use cases.

- Ethereum (ETH): Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (DApps) on its blockchain.

- Litecoin (LTC): Created as the “silver to Bitcoin’s gold,” Litecoin offers faster transaction confirmation times and a different hashing algorithm.

- Ripple (XRP): Ripple aims to provide fast, low-cost international money transfers, and its technology has been adopted by financial institutions for cross-border payments.

- Cardano (ADA): Cardano focuses on sustainability and scalability, aiming to provide a platform for the development of decentralized applications and smart contracts.

- Polkadot (DOT): Polkadot facilitates interoperability between different blockchains, allowing them to share information and assets seamlessly.

Environmental Concerns and Sustainable Solutions

Bitcoin mining’s energy consumption has raised concerns about its environmental impact. Efforts are underway to develop more energy-efficient consensus algorithms and promote sustainable practices within the crypto mining industry.

- Proof of Stake (PoS): Unlike Bitcoin’s Proof of Work (PoW) consensus mechanism, PoS relies on validators who hold and “stake” a certain amount of cryptocurrency to secure the network, significantly reducing energy consumption.

- Renewable Energy Integration: Some mining operations are exploring the use of renewable energy sources, such as solar and wind power, to power their operations and mitigate their environmental impact.

- Carbon Offsetting: Initiatives are being developed to offset the carbon footprint of cryptocurrency mining by investing in projects that reduce greenhouse gas emissions.

- Blockchain Innovations: Research and development are ongoing to create more energy-efficient blockchain technologies that can maintain security and decentralization while reducing energy consumption.

- Community Engagement: Many in the cryptocurrency community are actively discussing and promoting sustainable mining practices to ensure the long-term viability of the industry.

Bitcoin’s Impact on the Financial Industry

The rise of Bitcoin has sparked discussions about the future of finance. Traditional financial institutions are exploring ways to incorporate blockchain technology and digital assets into their operations, potentially revolutionizing the industry.

- Efficiency and Speed: Blockchain technology can streamline financial processes by reducing the need for intermediaries and automating various aspects of transactions and settlements.

- Reduced Costs: By eliminating intermediaries and automating processes, blockchain technology can significantly reduce the costs associated with financial transactions and services.

- Financial Inclusion: Cryptocurrencies and blockchain technology have the potential to provide access to financial services for individuals who are unbanked or underbanked, especially in regions with limited access to traditional banking.

- Smart Contracts: Smart contracts, self-executing contracts with the terms of the agreement directly written into code, could automate and facilitate complex financial agreements, reducing the risk of disputes.

- Tokenization of Assets: Traditional assets, such as real estate and commodities, can be tokenized and traded on blockchain platforms, increasing accessibility and liquidity for investors.

Conclusion: Embracing the Future of Digital Currency

As we conclude this comprehensive guide to Bitcoin basics, it’s clear that this digital currency has the potential to reshape the global financial landscape. Whether you’re a curious enthusiast or an investor, understanding the fundamentals of Bitcoin is a crucial step toward mastering the world of cryptocurrencies.

In a world undergoing rapid digital transformation, Bitcoin represents a revolutionary leap in the evolution of money and finance. As adoption continues to grow and innovative use cases emerge, it’s becoming increasingly evident that Bitcoin and blockchain technology are here to stay, bringing about a future that holds both exciting possibilities and unprecedented challenges.

FAQs

No, Bitcoin is just one of many cryptocurrencies available today. There are thousands of other cryptocurrencies, each with its own unique features and use cases.

When selecting a Bitcoin wallet, prioritize wallets that offer strong security features, such as two-factor authentication and hardware wallet support. Research the wallet provider’s reputation and user reviews.

While it was possible to mine Bitcoin using personal computers in the early days, the increasing complexity of the network requires specialized hardware known as ASICs (Application-Specific Integrated Circuits) for efficient mining.

Blockchain serves as a decentralized, transparent, and tamper-resistant ledger that records all Bitcoin transactions. It ensures the validity and security of each transaction while preventing double-spending.

To start investing in Bitcoin, you’ll need to create an account on a reputable cryptocurrency exchange, complete any required verification steps, and fund your account. Once funded, you can purchase Bitcoin and store it in a secure wallet.

Bitcoinnewsmagazine is committed to providing impartial and reliable insights into cryptocurrency, finance, trading, and stocks. It's important to note that we do not provide financial advice, and we strongly encourage users to conduct their own research and due diligence.

Read More